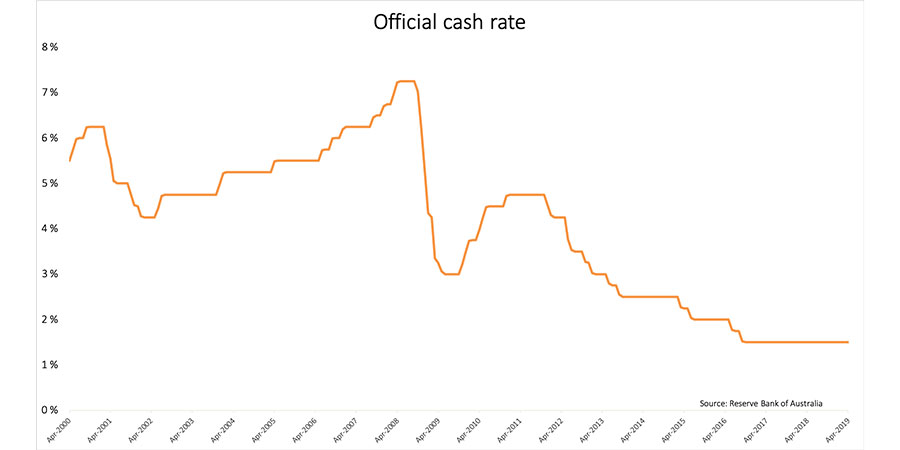

According to futures markets, on May 7 there was a 38 per cent chance that the Reserve Bank of Australia would cut official interest rates. As it panned out that was a pretty good indicator: on the day, the RBA sat tight and left official rates unchanged at 1.5 per cent.

It goes without saying that when rates are this low (and potentially going lower), and when clients are accumulating cash in the face of ongoing investment uncertainty, managing clients’ holdings effectively and efficiently is a more challenging task then when rates are higher, or when higher-return investment opportunities are plentiful and more obvious.

And advisers need to be alert to factors in the market that can distort clients’ cash returns, quite apart from RBA movements. An analysis undertaken in mid-2018 found that cash rates then offered on platforms ranged from 10 basis points to 100 basis points less than the prevailing official cash rate.

This points to two issues: first, cash ain’t just cash. How it’s managed can make a material difference to clients’ outcomes – the difference between earning 1.5 per cent a year and earning 0.5 per cent a year adds up over time. Second, advisers clearly need a range of options and alternatives, off-platform as well as on-platform, to achieve the best results for clients.

Best practice in cash management can be difficult to define precisely. How cash is best managed is dictated by what a client needs it for. If it’s a held as part of a long-term asset allocation strategy that’s one thing. If it’s being accumulated in the short term, to be invested elsewhere later, that’s another thing. The tools available to advisers need to be relevant in each scenario, and while the interest rate may be a critical factor it’s also important that cash-management tools deliver to advisers the flexibility and insights they need to do the job as well as possible.

CoreData is currently asking financial advisers to learn more about how they use cash-management products and services, additional features advisers might need or value to do their job properly, and anything that’s getting in the way of advisers doing the job as efficiently as possible.

It takes about 15 minutes to complete – and as well as being used to develop better cash management solutions, it will also be used to develop an adviser-focused content demonstrating best-practice in cash management, and the innovative and interesting ways advises are finding to manage clients’ cash, and cash-flow, most efficiently. This publication will be available to all advisers free of charge.

Feedback from real-life users is the best way to gauge the strengths and shortcomings of any product or service, and to develop better solutions. Spending 15 minutes to describe your experiences will help develop better services for advisers, and better results for clients.