As the COVID-19 pandemic continues, many businesses are turning their attention to recovery. But a range of challenges have emerged as potential roadblocks, with CoreData’s latest COVID-19 Pulse Check of Australian business suggesting workforce-related issues were as significant as cashflow challenges.

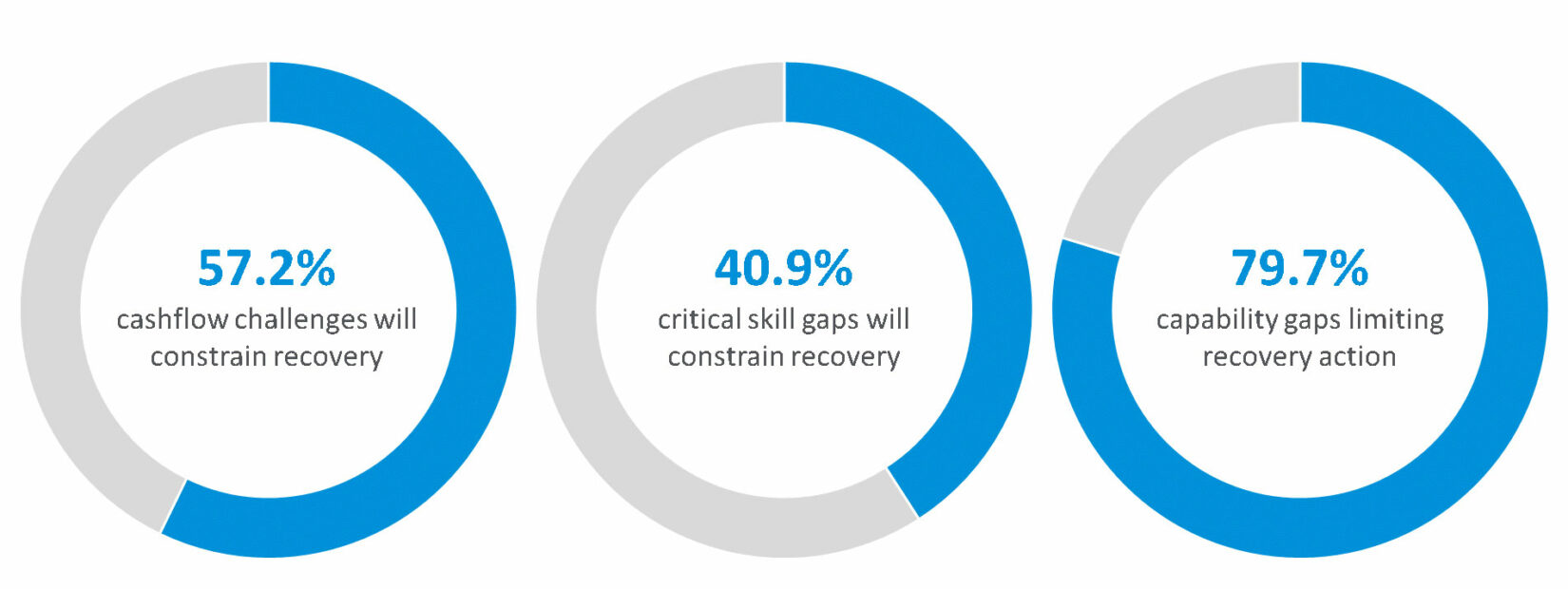

Our survey of more than 300 business owners and leaders in late July found that while cashflow challenges will constrain the recovery of almost three in five (57.2 per cent) businesses, a similar proportion of leaders foresee staffing/personnel issues (54.2 per cent) as a roadblock to their recovery.

Concerningly, forced workforce downsizing in the face of free-falling revenue now sees a third of businesses confronting critical skill and knowledge gaps (40.9 per cent and 36.7 per cent respectively). The result is a lack of capability to undertake desired recovery activities among four in five businesses (79.7 per cent).

State governments are not oblivious to this, with funds being poured into the provision of free, and heavily subsidised short courses and qualifications, in a coordinated effort to inject required skills and knowledge into the labour market and businesses. With a finite bucket of money, pinning down what to fund has always been a challenge, but our recent Pulse Check uncovered three key capability gaps that are likely to impede business recovery.

• Digital capability

• Customer engagement

• Personnel management and development

Challenge 1: Digital capability

Perhaps the most obvious. Video-conferencing and other digital communication tools are in no way new innovations, but despite clear cost benefits over travelling to face-to-face meetings, the uptake and embedding of video conferencing as part of BAU has long dragged. As a consequence, COVID-19 has driven a sudden, typically reactive approach to its implementation. In an environment where competing priorities and financial pressures are at play, there has been little time or budget for planning and training of staff to use chosen digital tools and platforms.

And it’s more than just the technical skills that impede effective use of digital communication in organisations. There is also the question of etiquette in remote internal and client meetings. Who hasn’t had stories of people doing wildly inappropriate things on group video chats pop up in their newsfeeds, or lamented family membersrandomly appearing in view as partners, pets and kids go about life in a home that is suddenly also a workplace?

Good digital culture is not necessarily something the develops organically. Unaddressed, digital skill and knowledge gaps have the very real potential to disrupt and even derail recovery, given more than half (53.3 per cent) of businesses anticipate continuing greater use of digital technology in general, and many expect more staff to remain working at home (38.3 per cent). In fact, all of the top three changes anticipated over the next 12 months are digital. Already, more than one in five businesses (21.6 per cent), say it’s likely lack of digital communication and technology capability will impact recovery.

The take-home? While there is an obvious increase in demand for skilled IT professionals, there is an equally pressing need to bolster the digital literacy across the board.

Challenge 2: Customer engagement

We know COVID-19 has been life-changing for many Australians. Looking forward, few are optimistic their position will improve in the next 12 months (25.8 per cent) and a third say they will not return to pre-COVID discretionary spend levels for more than 6 months, at least.

Many businesses realise they lack understanding of changed customer needs, with 40.4 per cent saying this was likely to hamper their recovery. But resolving this is a complex challenge and not simply about closing the customer engagement skill and knowledge gaps, which are impacting recovery activities of almost a quarter (24.0 per cent) of businesses. Rather, customer engagement needs to be underpinned by R&D (a capability lacking in 12.5 per cent of businesses), which requires sound data collection and analysis (a capability lacking in 16.8 per cent of businesses) to develop evidenced-based customer engagement strategies.

An inability to effectively engage with and understand customers, and prospects for that matter, leaves a business vulnerable at the best of times. But in this context, the results are likely to be catastrophic, especially where strategic capability is also limited -an issues for one in five businesses (21.1 per cent) – making the chances of an informed path to recovery being mapped out and followed successfully remote at best.

The take-home? Many businesses lack understanding of their customers’ needs, but R&D, data and strategic capability gaps will need to be addressed to remedy this.

Challenge 3: Personnel management and development

More than half of businesses say they face staffing/personnel challenges, while lack of personnel and workforce management capability was the second most commonly reported capability gap (22.1 per cent).

Without this capability, a business will struggle to understand where skills and knowledge live, where the gaps are, and how best to close them. This is concerning given more than one in five (21.4 per cent) say they lack capability to undertaken job-specific technical activities and more than a third (38.3 per cent) offer limited training, or put it on hold completely, in response to COVID-19.

The obvious consequence is that skill and knowledge gaps will continue unaddressed, hampering business recovery. And for those businesses who are seeking to bring in required skills, impaired revenue streams mean little tolerance for costs associated with personnel missteps, such as recruiting the wrong people or losing the ones you want to keep.

Tellingly, when we asked businesses what support measures would most help their recovery, an extension of Jobkeeper (24.4 per cent) barely edged out funding for business transformation and diversification (24.2 per cent) and access to affordable/subsidised business training (23.0 per cent) to address their capability gaps. Clearly, businesses know they need to make changes to recover and survive, and they want to build their internal capability to do so, rather than bring in consultants (10.9 per cent) and advisers (10.8 per cent) to guide them.

The take-home? Businesses want to make informed decisions about their future direction and strategy, and see training and targeted business funding as the most helpful means to do this.

Meeting the challenge

Given the ramifications of the capability gaps and challenges reported by Australian businesses, getting the response right is crucial. The difference now is the luxury of paying lip service to innovation is gone, and just like video conferencing, COVID-19 has forced businesses to pivot and transform service delivery, product, or target market to survive.

As struggling businesses are forced to release trainees and apprentices, and universities struggle in the face of shrinking international student revenue, there is capacity in both sectors. And equally there is demand, particularly for short-courses. TAFE NSW alone received more than 100,000 enrolment requests for 21 short courses recently made available free of charge (1).

This suggests availability and affordability per se, will not be the blockers when it comes to skilling individuals to fill capability gaps in businesses. The challenge lies in determining the most critical gaps that need closing, and this information can only come from business leaders themselves. Leaders that continue to juggle competing priorities, and often lack granular knowledge and understanding of the skills required to perform specific roles within their organisations.

As we continue to look to the future and determine how to maximise spending to support business recovery, data and insight are critical pieces of the puzzle to ensure decisions are made from a robust evidence base.