In early March, Australia’s top banking executives sat down with Treasurer Josh Frydenberg in a meeting originally intended to discuss the impact of the bushfire season on the local economy. Instead, the talks centred on COVID-19 and confidence among businesses and investors, and potential levers the Federal Government could pull to protect local households.

Much of the responsibility was to rest on the Australian banking system. Tasked with leading the ‘Team Australia’ approach, the banks have offered to defer repayments on loans, including mortgages, for a period of three to six months.

The concessions provided by the banking industry have been a lifeline for many mortgagors. According to the Australian Banking Association, local banks have now deferred more than 450,000 mortgages, totalling $165 billion.

The broader impact of the COVID-19 pandemic on the banking and lending sector is summarised in CoreData’s COVID-19 Banking Snapshot, which includes insights into:

• How Australians are protecting their finances during a public health crisis

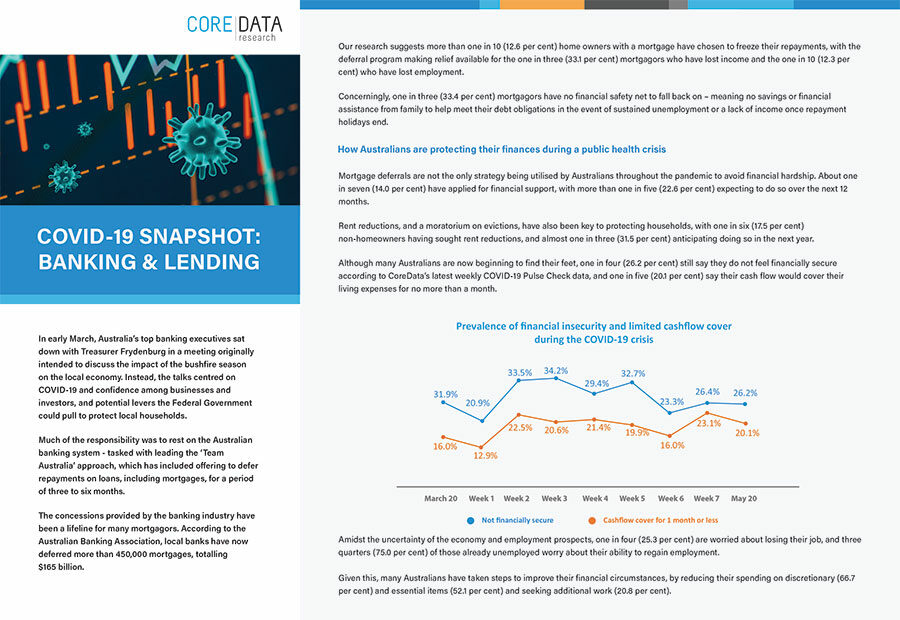

• The prevalence of financial insecurity and limited cashflow cover

• How property price expectations weigh on banking industry

• Whether Australians believe the think the worst is behind us or yet to come

Click on the image below to read the full snapshot:

Read CoreData’s other COVID-19 Snapshots: