“I have opinions of my own, strong opinions, but I don’t always agree with them.”

– George HW Bush, 41st President of the United States of America

Opinions. We’ve all got them, and they frequently let us down. If you’d asked me before the federal election on May 18 who I thought was going to win, I’d have had an opinion and reasons to support that opinion, and I’d have been wrong. Not quite as wrong as Sportsbet, though – at least my mistake didn’t cost me $5 million.

Absent a change of government, the financial advice industry needs to assess what its future looks like under a Morrison government, and perhaps most centrally of all, what a re-elected Coalition government means for the ongoing operations of the Financial Adviser Standards and Ethics Authority (FASEA) and implementing the recommendations of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry.

If I were a betting man (and after the election I’m reconsidering the wisdom of that) then I’d wager that little will change on the FASEA front, and that while the Coalition has committed to implementing all but one of the royal commission’s recommendations more or less in their original form, it may take longer to get it done than if a Labor government had come to power.

FASEA is the Coalition’s baby

Don’t forget that FASEA is the Coalition’s baby. It has its genesis in a 2014 report of the Parliamentary Joint Committee on Corporations and Financial Services, Inquiry into proposals to lift the professional, ethical and education standards in the financial services industry, an inquiry chaired by Liberal senator David Fawcett. That inquiry recommended creating something called the Financial Professionals Education Council (FPEC – not to be confused with the Financial Planning Education Council) to oversee and implement university-level education qualifications for advisers, institute a professional year, and establish a registration exam.

Legislation creating and empowering FASEA, the Corporations Amendment (Professional Standards of Financial Advisers) Act was developed and enacted in 2017 under the watch of former Minister for Revenue and Financial Services, Kelly O’Dwyer – another Liberal. It would seem unlikely that the Morrison government would proclaim the whole of the Coalition-driven FASEA project to have been a mistake and then to change it significantly.

Unlikely, that is, but not impossible. They do, after all, have form on seeking to water down reforms on financial advice.

The industry may hope that a Morrison government will slow or stall implementation of the royal commission recommendations – after all, the Coalition didn’t want the inquiry in the first place, remained implacably opposed to it until it became inevitable, then embraced it in what was a case-study in political expediency.

Back up carefully

Having thus had to champion the cause of the consumer by backing the inquiry and publicly supporting its recommendations, it would be a very delicate process to reverse that position. But I’ve been wrong before – as recently as election weekend – and there have been bigger turnarounds in political history than that would represent.

But it would be a tricky turnaround to pull off, particularly in light of how consumers feel about what they learned over the course of the inquiry about how financial services institutions have often operated. Don’t assume that as a participant in the industry your desired pace and appetite for change is shared by the general community outside your office.

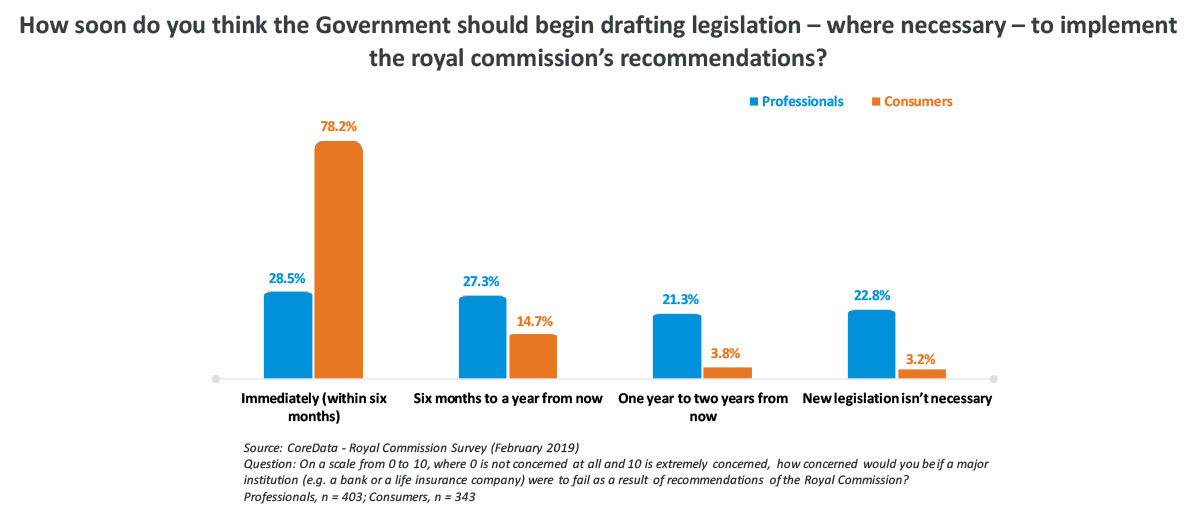

To summarise earlier research by CoreData, consumers said the inquiry’s recommendations go far enough, they want it all and they want it now; financial services professionals said the recommendations go too far, they don’t want as much to be implemented, and want the implementation staged over several years. In addition, consumers were far more blasé than professionals were about the potential damage to specific institutions or to the broader economy arising from the recommendations.

As an aside, they also want executives who are found guilty of serious misconduct to face jail time, and while we didn’t ask professionals the same question I’d say it’s a safe bet the answer would have been different.

So assuming new rules introduced last December really do make it harder to turf the leader of the parliamentary Liberal Party, we might bet we’re in for a period of relative political stability. We could likewise bet that FASEA’s work and the task of implementing the royal commission’s recommendations will continue in a relatively orderly manner.

It looks like quite a punt to assume differently. But anyone want to offer me odds?