The population of Chinese mainland high-net-worth individuals (HNWIs) has increased dramatically over the past decade. According to a global wealth report issued by Knight Frank in 2018, the number of Chinese with net assets of more than $US5 million ($7.2 million) almost doubled from 2012 to 2017, and the total value of HNWIs’ investable financial assets has reached $US5.8 trillion. A growing number of financial services providers are grappling with what drives HNWI decision-making, and how to most effectively reach them.

A recent survey conducted by the Boston Consulting Group (BCG) and China Construction bank predicts that the population of China HNWIs is to increase by 8 per cent a year in the upcoming five years. It also shows that generally, Chinese HNWIs are becoming more risk-sensitive, and new-generation HNWIs have demonstrated stronger willingness than older generations to invest overseas in the next three years.

One major issue particularly concerning Chinese HNWIs is that they cannot be certain whether the wealth they have accumulated is legitimate. If corrupted officials are “black”, and the working class are “white”, what about entrepreneurs who are stuck in the middle? The legal environment for wealth growth has been ambiguous. As the old Chinese proverb says: “Muddy water makes it easier to catch fish.”

Entrepreneurs often find that they are free, or even encouraged by the government, to explore and exploit virgin fields; however, after they have enriched themselves, they also find themselves falling into an awkward position where their spirit of innovation can be criticised as violating the “rules”. The Chinese cohort, compared to its western equivalent, worries more about political, legal and confiscation risk.

The first wave of entrepreneurship in China has built wealth successfully and has become the source for stories of winning wealth overnight. The government is clearly aware of the importance of maintaining existing wealth in the country to encourage larger-scale wealth creation.

There are two ways to do this. One is to establish policy barriers, and the other is to create a friendly capital environment plus a complete legal system so that the old money feels safe but still recognises the possibility of making more money. The latter brings long-term value, and there have been signals of regulators moving towards capital liberalisation yet the pace remains uncertain.

The preferences of Chinese HNWIs are also shaped by the transition of their life cycle and the change of market environment. As shown in the chart below, today approximately 50 per cent of Chinese HNWIs are over 50 years old and have stepped into a new stage of the wealth management cycle. Their primary focus has shifted from fast wealth appreciation to wealth preservation. Interestingly, compare to average HNWIs, ultra HNWIs are more concerned about wealth inheritance.

A survey by Boston Consulting Group (BCG) and China Construction Bank (CBC) shows that more than 50 per cent of Chinese ultra HNWIs have already or are about to take actions towards wealth inheritance. HNWIs’ expectation of return on investment has been rectified by the macroeconomic environment and echoes the increasing investment risk in 2018. Many HNWIs interviewed by BCG hold the view that as long as their principal capital is preserved in the short term, or even if the return on their investments drops slower than the market average, their investment can be defined as successful.

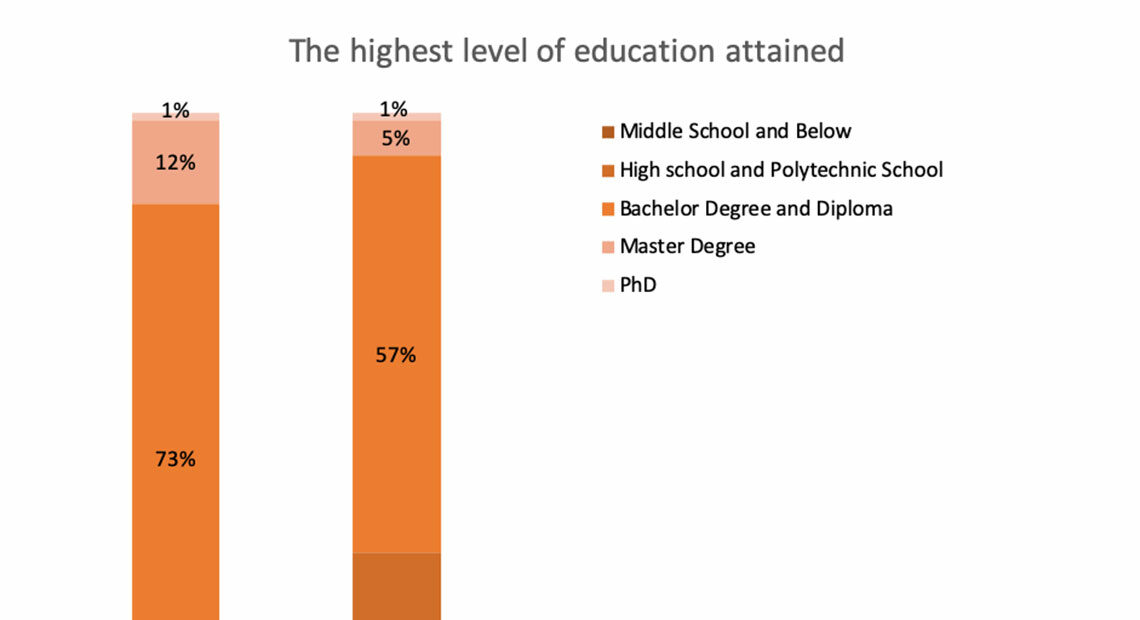

Younger HNWIs come with better education and a more mature grasp of wealth management; they also tend to be autonomous in decision-making and open-minded to innovative financial instruments. Yet given all these features, to survive through bear markets, to distinguish prime investment opportunities and to sustain their wealth in the long term, they will need more patience and rationality.

Against a backdrop of economic-deleveraging, the continued slump of the stock market, the increased default of bonds and other financial products including peer-to-peer online loans, they have lowered their expectations and become more cautious. In the near future, the Chinese HNWIs are likely to increase their holdings of low-risk assets.

The survey also finds that they are most interested in strategic asset allocation strategies services from private banks (60 per cent consider it important). In terms of other value-added services, they consider high-end healthcare service the most important, followed by aged care, legal advisory and tax planning.

Now that the muddy water is getting clearer, we hope to see a thriving wealth management industry that creates win-win situations, in the context of a mature legal system.