Australia’s robo-advice sector continues to battle a lack of awareness among consumers and has struggled to gain a foothold in the Australian investor market. Some early entrants to the market have already scaled down operations or shut down altogether.

Low awareness is not a new issue – CoreData robo-advice research in 2017 found that the vast majority (84.1%) of Australian investors had not heard of or were unsure of what robo-advice is. Without a decent track record since then on which to gauge the performance of robo-enabled advice, take-up is likely to stay low and prospective clients may remain disinclined to trust them with their savings.

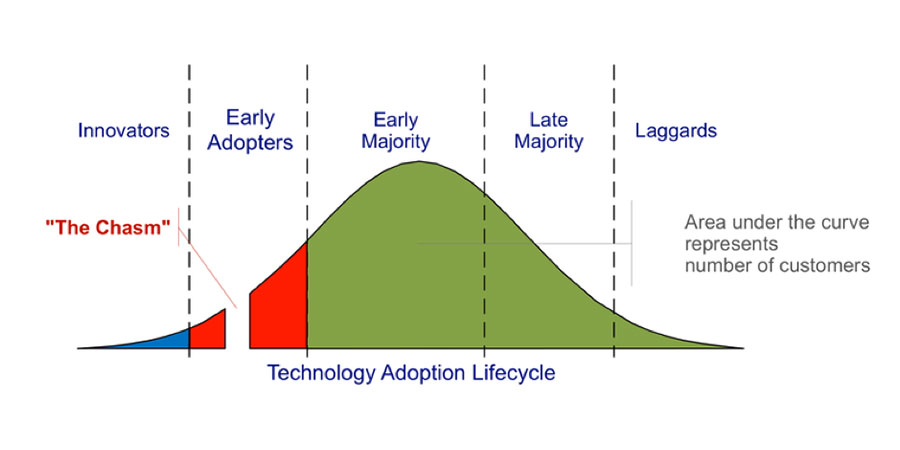

The challenge facing the robo-advice industry is typical for any relatively new technology seeking to gain greater customer adoption in the market: how can it cross the chasm between take-up by innovators and early adopters and take-up by the mainstream?

Encouragingly however, recent developments in the Australian financial services industry could finally see robo-advice clear the chasm.

The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry makes it likely that traditional financial advisers and licensees will face revenue headwinds and increased costs. Many financial advisers are also likely to exit the industry, particularly given the new set of standards on education, professionalism and ethics set by the Financial Adviser Standards and Ethics Authority (FASEA).

Unless there is a sudden influx of new human advisers, these changes mean that financial advice may become less available and less affordable for the mass market and present an opportunity for robo-advice providers to fill what is likely to be an under-serviced segment.

Robo-advice’salgorithm-based approach to its task means the selection and managing of investments is less likely to be swayed by the financial adviser’s or the firm’s own interests, addressing some of the issues that arose during the Royal Commission and potentially improving consumer trust in the process.

But there are some specific issues the robo-advice industry must address before it is likely to achieve mainstream acceptance.

The robo-advice on-boarding process is typically limited to an on-line questionnaire, which confines the information collection process and prevents a richer understanding of clients and their advice needs. Most robo-advice platforms are also not developed enough to handle complex financial situations, rendering them capable of performing only a narrow set of functions around investment selection and management.

One-size-fits-all won’t work

In addition, digital habits between the age generations tend to differ, making a one-size-fits-all approach less appropriate, and difficult to perfect. CoreData’s research found that the challenge in bringing younger investors on board is to demonstrate value through low fees, accessibility and speed of transactions. On the other hand, the challenge in bringing older investors on board is to demonstrate transparency and control, as they typically have concerns around privacy, how their money is invested and investment performance.

Financial goals are a critical component of developing advice solutions, and are often the framework through which financial outcomes are measured. Robo-advice providers should ensure that this is the focus of future development. Providers should also work towards tailoring an offer to respond to the specific concerns that different client segments have, andstreamline the on-boardingprocess, which will allow robo-advice platforms to offer an improved client experience and to capture richer data, and therefore provide better advice.

Over time, robo-advice will develop a track record and garner an increased uptake, particularly if it can demonstrate that it can address the issues that arose during the Royal Commission, around fees and trust. Perhaps then, it could finally cross the chasm and enter the mainstream.