Concerns over conflicts of interest in financial advice have prompted the Productivity Commission to recommend a range of measures to help more superannuation fund members make better decisions about super without having to “resort” to seeking advice.

A Productivity Commission report, Superannuation: Assessing efficiency and competitiveness, released yesterday, says access to impartial advice is a critical factor in improving the efficiency of the superannuation system and achieving better outcomes for members, in both accumulation and decumulation phases.

But it says despite recent regulatory reforms, including the Future of Financial Advice (FoFA) reforms of 2012, “the presence of conflicted financial advice remains both egregious and problematic”.

It says higher education, professional and ethical standards under development by the Financial Adviser Standards and Ethics Authority (FASEA), along with an expectation of greater activity by regulators, will help to lift the quality of advice, but these reforms “do not address the fundamental problem of conflicted financial advice”.

“And they also reduce the supply of advice services and increase their costs,” the commission says. Its solution is to create an environment there members can make better decisions for themselves about superannuation and related matters, without having to “resort to expensive financial advice”. The commission’s recommendations include:

• Improving dashboards and disclosure, to help members make (and financial advisers inform) better decisions;

• Establishing a “best-in-show” shortlist to help members compare funds and products, to enable wiser switching decisions and to provide clear and unavoidable “if not, why not” points of reference for financial advice;

• Removing grandfathered trailing commissions, minimising the conflicts that such payments promote;

• Raising the quality products by introducing a more stringent outcomes test) to reduce the risk of a member switching to “a particularly poor product”;

• Improving governance to address conflicts of interest in vertically integrated organisations; and

• Establishing a well-resourced, independent member advocacy and advisory body to represent fund members on financial advice policy deliberations (among others), and help members interpret complex information.

The commission recommends that the term “advice” should only be allowed to be used if it relates to “personal advice” – or advice that takes into account an individual’s specific circumstances and needs. And it wants financial planning licensees to disclose to The Australian Securities and Investments Commission (ASIC) how many products are on the licensee’s approved product list (APL), how many of those are in-house products, what proportion of recommendations relate to in-house products, and what proportion of recommendations each year are off-APL – and ASIC should publish this information each year.

The Productivity Commission’s proposal for a list of “best-in-show” superannuation funds would see an as-yet undefined “independent expert panel” create a list of funds from which members entering the superannuation system for the first time can choose, or be defaulted into by employers, and which all fund members can use as a guide to the “best” funds currently available.

While the PC report does not go as far as to say financial planners should not recommend a superannuation fund that does not appear on the best-in-show list, the expected high public profile of the list will significantly increase pressure on advisers to justify a decision to recommend a fund that is not on it.

“The best-in-show shortlist will help by serving as a discernible (and unavoidable) point of reference,” the PC overview document says.

“It will help advisers (in recommending products), their customers (in putting pressure on advisers to explain why any product advice diverges from the list), and also the regulators (in enforcing financial advice laws).”

The best-in-show list also would have some repercussions for the financial advice divisions of those funds who do not appear on the list when dealing with a member wanting to switch out of the fund.

The PC report says super funds spend an estimated $154 million a year, or about 0.02 per cent of fund assets, on “different types of advice and tools to help members plan, with most on general and superannuation advice and least on planning tools”.

“Some funds have been embracing online and digital capabilities and tools to do this,” it says.

“Although still in the early stages of development, a few funds had begun to recognise the benefits of digital advice, partnering with digital advice platforms to roll out the capability to their members.”

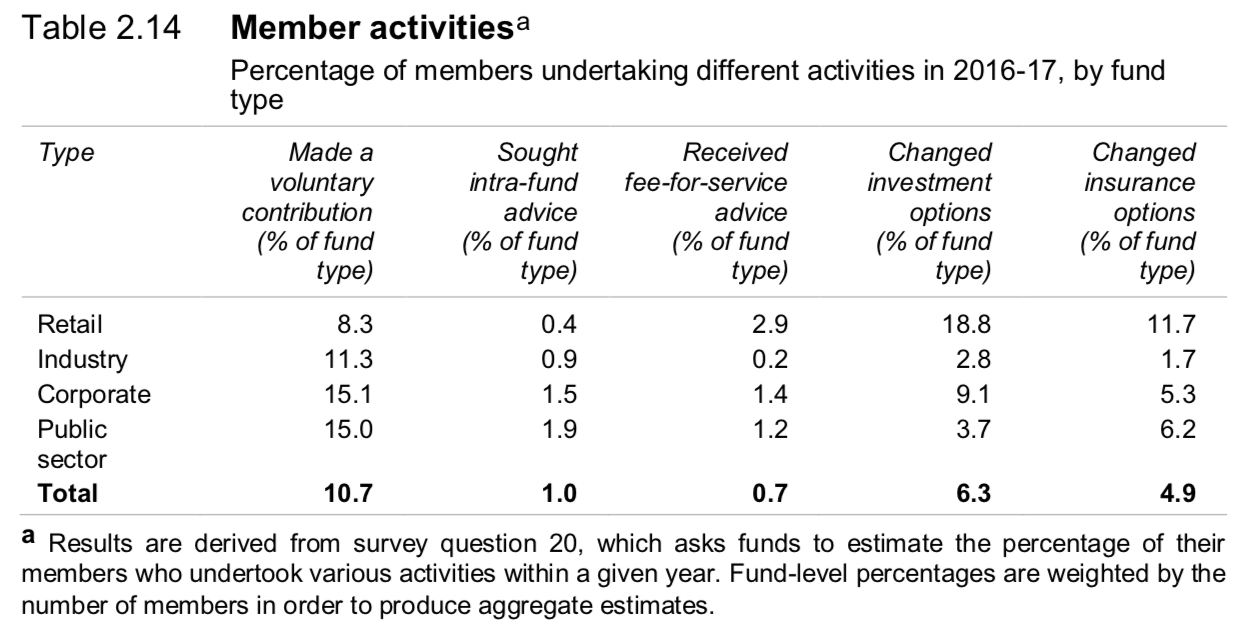

Only a tiny fraction of fund members receive advice, according to the PC report. Funds surveyed by the commission spent an estimated $154 million in 2016-17 providing intra-fund or fee-for-service advice to less than 2 per cent of fund members.

Members of retail funds receive more fee-for-service advice than members of any other type of fund; and members of public-sector funds are most likely to see intra-fund advice than members of other types of funds.