Online mortgage application systems are fast becoming a preferred way for “core-affluent” consumers to compare home-loan options and find loans, a new report by CoreData Research’s Mortgage Intelligence Unit (MIU) has found.

The MIU report, Online consumer sentiment, has found so-called “outsourcer” core-affluent consumers aged under 30 are increasingly turning away from their traditional trusted advisers and are now the most likely demographic to apply online for a home loan.

The increasing shift online by this important demographic is putting pressure on lenders to develop and launch an effective online presence. About 10.5 per cent of all core-affluent outsourcers say they are dissatisfied with their current home loan and it is the segment of the market that that feels most strongly that they are “never offered a better product” by lenders.

CoreData defines core-affluent consumers as having an investment portfolio valued between $350,000 and $750,000, household income of between $150,000 and $250,000 a year, and personal income of between $90,000 and $150,000.

Failing to capture this demographic today may make it more difficult to win them as new customers in later years, when their needs are more complex and their value as customers is greater, and as it becomes more difficult to secure refinancing in the wake of tighter lending standards.

And lenders need to strike a balance between requesting enough information from potential customers to enable an application to be processed, without asking for so much that the process puts them off.

A second MIU report looked at the acquisition process of online mortgage providers by tracking customers experience from application input, submission, approval and subsequent intention through mystery shopping by real customers looking for a home loan. The findings showed that intention to purchase online decreased as the as the information required to get a faster approval increased.

Core-affluent consumers stand in contrast to mass-market consumer, whom the sentiment report identifies as “a difficult target for online mortgage businesses”. A mass-market consumer typically has investments outside of superannuation worth less than $50,000, household income of less than $75,000 and personal income of less than $40,000.

The MIU report says that while the willingness among mass-market consumers to purchase online is very high (62 per cent), actual demand is lowest of all segments. The report says this is driven by a higher need for validation when applying for a home loan and that the large sentiment-decision gap implies that market potential is underutilised, but that the cost of mass market opportunities would be the highest.

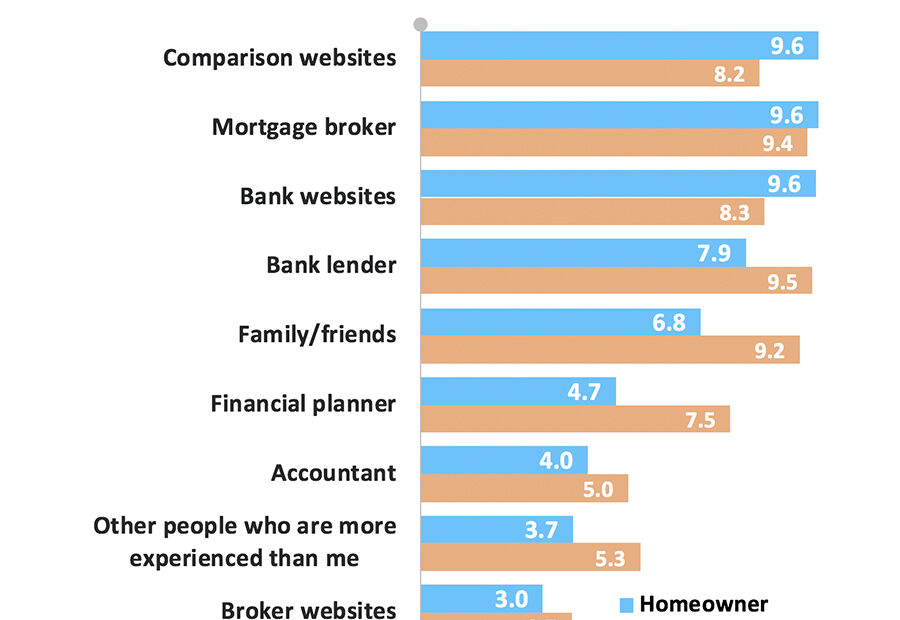

The MIU report has found there are a number of essential elements to an effective online offer and getting them all right is critical: most consumers are not only doing their initial research online, they are placing an increasing reliance on it (see charts below).

Many are turning to online forums to research the market and, in addition, most consumers who applied online first read an online review (Chart 2), which influenced their decision on who to go with. Almost 80 per cent of consumers said a positive online review would increase the level of trust, positively influence their perceptions and increase the likelihood of applying online with them.

But the research has found that developing an effective online presence isn’t a challenge unique to lenders. Mortgage brokers who rely on word-of-mouth referrals for new business also face a growing threat from increasing numbers of consumers turning to online sources for recommendations and reviews. For brokers the solution is to develop an effective online presence that reflects the positive experiences customers have had dealing with the broker.

Chart 1

Assuming you were to buy your first home, refinance your existing home loan or apply for your next home loan, which of the following information sources would you rely on most in your research process?

Chart 2

Assuming you were to apply for a home loan online, how likely would you be to read online reviews before making your decision?

Follow CoreData on LinkedIn: www.linkedin.com/company/coredata-group/