Bugger Married at First Sight, the best TV ever is watching the Royal Commission on the feed while you are working, or better yet, listening to it as you attack yet another data cube.

The star of this show is Ken Hayne, and I’m going to have to put this out there: I’m a little bit in love with Ken. It’s not his persistent veiled jibes about timing or veracity or time wasting, slipping in either accidentally or on purpose little bits of Alfred Tennyson, Thomas Sterns Eliot or even Stephen Sondheim into his comments – I have no idea if this is on purpose or not – but I THINK when he says sitting well in order? then we will begin – he’s referencing Ulysses – you know; sitting well in order we will smite the sounding furrows and all that…

So its not the literary allusions, it’s the fact that he knows his stuff and he’s dry as a dead dingo (1). Turns out he’s the type of Judge you’d like to have a beer with. Who knew?

Then there are the parts being played by Rowena Orr and Michael Borsky (QC). Watching Rowena Orr’s measured, intelligent approach is like watching someone you know being water tortured. Slow measured and deliberate; she’s a car crash in slow motion – you know how this is going to end and it’s going to be pretty bad – she’s just taking sweet her time getting there and you can’t look away.

Borsky is different. It’s like watching the same car crash – but instead of the black and white cinema verite tones provide by Ms Orr, with Borsky – you get the same scene lit by flash photography – he looks like he’s the detective who rushed into the court at the last moment, suit not fitting properly, tie askew relying on brilliance rather than planning.

Then there are the witnesses, I’m not going to name them, because I know most of them. They are the human face for the sins of the system and mostly (and I say mostly advisedly) don’t deserve it, but it’s torture watching them.

It’s torture especially when you know the ones that are decent honest and thoroughly thoughtful people being forced to answer questions about a businesses they inherited, about decisions they didn’t make, when you know the architects of problems they are asking questions about aren’t even, or are at least are not yet, in the room.

I often wonder why they don’t just say: “look Ken, this wasn’t me, this was built by person (x), signed off by person (y) and I’m sitting here trying to justify decisions I didn’t make and to tell you the truth Ken, I’ve been trying to slowly get rid of this for the past five months that I’ve been here without, and let me put this bluntly Ken, without, losing my job…”

It’s really fascinating – some of the businesses being examined at CoreData we know quite a bit about – we’ve been researching them for 17 years – we’ve seen the products and the people come and go, we gasped like a North Shore matron watching a house guest lick peas off their knife, when some of the products were introduced and we said to each other – “well that’s bullshit. How’s that going to end?” As new products were rolled out or other products were gutted so that service would drop and profits would peak.

Let me be clear – I haven’t listened to everything, but at no stage during what we’ve seen have we seen a witness delve into mendacity to cover their arses. So far, it’s been pretty straight forward all the way and they have taken someone else’s medicine with a straight face.

We should point out there is the commission’s fascination with things that are irrelevant or at least not really material – or based in some fantastical idea of the world – where commercial reality and behavioural economics don’t exist. Like looking at the infected toenail of the Elephant while the persistent brain tumour throbs away, but I suspect the commission, Peter Falk as Columbo style, might just be winding up to that.

But let’s acknowledge something here: There is no perfect world.

Let’s all acknowledge mistakes are made and systems fail – but by and large the banks, the building societies and the insurance companies do a pretty decent job. And that the alternatives – Government provision of these services or no provision of these services are pretty horrible.

There are 16 million credit cards issued in Australia – let’s say that the average Australian has two. Just for the simplicity of the maths – I know the number is slightly higher, I know we have the data somewhere, but when I bellowed across the office to ask the guy who covers that area the number – he said : “Not sure – it’s in the data cube – look it up,” and I can’t be bothered at the moment.

Oh hang on I’ll do it, I’m slightly neurotic and I hate leaving work unfinished.

Ok turns out we’ve looked at it by age group and between 18-35 the average is 2.2, 36 to 54 the average is 2.6 and 56 it drops again to 2.1. The cheapest card according to this data is Community First Visa. There you go – now you know. (3)

Now, as Ken Hayne would say “we roll on, we roll on…” a line delivered dry as a Bethanga Summer and containing a sense of impending doom.

So here’s the thing about credit cards or home loans or car lending – if we say that there are 8 million people using them, let’s say once a day and we acknowledge that there is no such thing as a perfect service then we have to have a tolerance for error. Mistakes after all will be made.

What’s the tolerance for error on this 1%? 80,000 mistakes? 0.5% 40,000 mistakes? What’s the tolerance for fraud on this. We have to figure what this number is because it cannot be zero. (2)

Maths doesn’t work that way. You know that right? No matter how much you would love it to be – it just doesn’t work that way. People don’t work that way, there is no zero.

One of the fun things that you can do if you own a research business is do research.

This year in January – I wanted to take a baseline of what people thought about the Royal Commission – so I got one of the very smart young people working for me to design up a baseline survey of consumer view of banks, service providers and the Royal Commission – with the idea that we would repeat it every quarter and then see if the Royal Commission has any impact on the industry – from the customer perspective.

We also collected data on people who work in the industry and what they thought – but that’s for another time. It’s a whole other report to be honest.

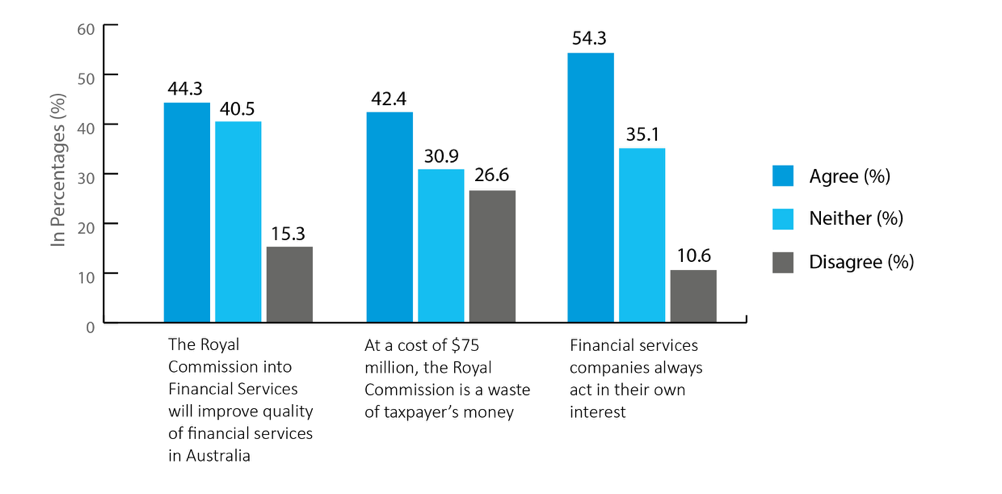

Our research shows that only 44.3% of consumers believe the inquiry can produce recommendations that will improve the quality of financial services, and 42.4% believe the inquiry is a waste of taxpayers’ money.

Only about a quarter of consumers (26.6%) thought the inquiry represents money well spent, and only 15% believe the inquiry will improve the quality of financial services.

Our research was conducted ahead of the inquiry’s first public hearings and will be used to track changes in perceptions and in levels of trust across the industry, as the inquiry progresses.

The research suggests the community had a particular expectation of financial services even before the hearings began: more than half (54.3%) of all people agree with the statement that “financial services companies always act in their own best interests”. Only 10.6% of people think financial service companies do not always act in their own best interests.

Across the divide – how politics affects perceptions

CoreData’s research shows that political affiliation is reflected in trust in financial services providers and in attitudes towards the inquiry and expectations of its likely impact.

Coalition voters are more likely than Labor voters to believe the inquiry is a waste of taxpayers’ money. About 28% of Greens voters and roughly 44% of independent voters think it’s a waste of money.

Labor, Greens and independent voters are more likely than Coalition voters to agree that the problem with financial services is an industry-wide culture problem – a systemic issue, rather than a few “‘bad apples”.

This corresponds with views on the expected impact of the inquiry, with Coalition voters less likely than Labor voters to believe it will improve the quality of financial services in Australia.

Despite differences in opinion regarding the value and the expected outcome of the inquiry there’s a similar level of agreement across political affiliations on the issue of whether financial services companies always act in their own best interests, with 47.2% of Coalition and 46.7% of Labor voters believing that is the case.

How much do you agree with the following statements?

In SUPER we trust

Australians say they currently place greater trust in superannuation funds than in banks or financial advice firms. However, there is generally a high level of trust in these financial services providers; they all received trust scores above 60 points. (By comparison, government, TV media and print media received trust scores of less than 41 points.)

Please rate your trust in the following industries or institutions

Have a look at that chart. You know how we are doing a Royal Commission into banking? Turns out it’s a lot more trustworthy than the Government.

That’s a head spin, an institution that we don’t really trust is doing a review of an industry that we trust slightly.

The most trusted superannuation funds are mostly industry funds, led by Australian Super. AMP is the most trusted retail superannuation provider, ranking fourth. Overall, industry funds are regarded as the most trustworthy type of fund by almost three-quarters of respondents (74.2%), with retail funds rated most trustworthy by 22%.

I want to be really clear here, this isn’t detailed Trust research and it was pretty loose at this level the data behaves a lot like recognition – we have other trust research which is much deeper and shows different outcomes. It’s worth looking at this chart though for the relativities. Australian Super is three time as likely to be trusted as the closest retail fund.

Interesting eh?

Top five super funds in Australia by trustworthiness

In CBA we trust

Commonwealth Bank remains Australia’s most-trusted bank, despite recent publicity regarding poor financial advice and allegations of money laundering. NAB enjoys the highest trust rating among respondents in rural areas, while Westpac subsidiary St George enjoys the highest levels of trust in regional areas. One online-only bank, ING Direct, enjoys a relatively high level of trust, matching among respondents from cities, and trailing only St George in regional areas.

Top five banks in Australia by trustworthiness.

Here’s The Foot Note: This version of the data is the first of a six wave series that will be done quarterly. We will be asking other questions, but we will be repeating these to get a linear view. All the views expressed in this article are the views of Andrew Inwood. They do not reflect the views of any of the companies that he works for, but he finds all of this very interesting and will continue to research what people think and what they are doing. As a rule he tends to think that bad financial planners and lenders are the exception rather than the rule and the bad ones are easy to find – because they keep changing jobs and there is a whole other data set for that you might want to look at sometime.

Here are the references:

(1) Dry as a Dead Dingo’s Donger… one of the things that Debbie Paton, Wagga Wagga Farm Girl and friend at Wesley College, Sydney University the Summer of 1983/84 used to say.

(2). This isn’t my idea – read W Edwards Deming on this. Start with “Some Statistical Logic on the Management of Quality (1971)” and go from there. To be honest it isn’t even his idea – you could read Alfred Marshall or any number of people. If you want to know what Deming ever did – have a look at the German and Japanese manufacturing industries and go from there.

(3) Credit cards In Australia CoreData – every year since 2012. This was started by a very fine mathematician called John Phillips and a young man called Stan Tsigos who was then doing his Phd and gave up the bright lights of consumer research to be a university lecturer. They spent hours and hours unpicking the fine print of the credit cards and their opaque schemes and worked out which was the best value. Great work to be honest. Guess how many CoreData staff changed their credit cars after reading it. Yep you are right None. Turns out its convenience that drives behaviour no knowledge. Who knew… well you would hope the bloody Royal Commission.