There is a shift at work in Australia’s industry funds, a shift from the onboarding of new members and being the lowest cost provider, to member retention and member engagement.

There are a number of forces driving this behaviour – but the three big ones are demographics, economics and consolidation.

The demography of Australia is changing and this is having a big impact on super funds. Super funds grow in two ways; one – the net number of new people joining the workforce and two – when people choose to leave one super fund and join another fund.

At the moment the number of people joining the workforce is relatively low, but because of the casualisation of labor – job switching is higher. That means that the net number of new superannuation members is relatively low and the value of people joining the fund is low too – because job tenure and therefore member balances are relatively low.

At the moment our population growth is higher than normal – up from 1.25% a year in 2012 to 1.6% a year in 2016. But the truth of this is we aren’t having more babies – we are importing more people – 0.9% of the 2016 growth figure is people moving to Australia and the bulk of them are on visas which means they have jobs and jobs means super funds.

But 0.35% a year growth isn’t enough to maintain a super fund, especially when the mortality rate of Australia is 5.5%. It doesn’t even equal replacement.

The second driver is economics – the people that tend to leave super funds to find a new supplier, to put it crudely, tend to be older, wealthier and have bigger balances which means that when they leave they tend to have a bigger economic impact on the fund.

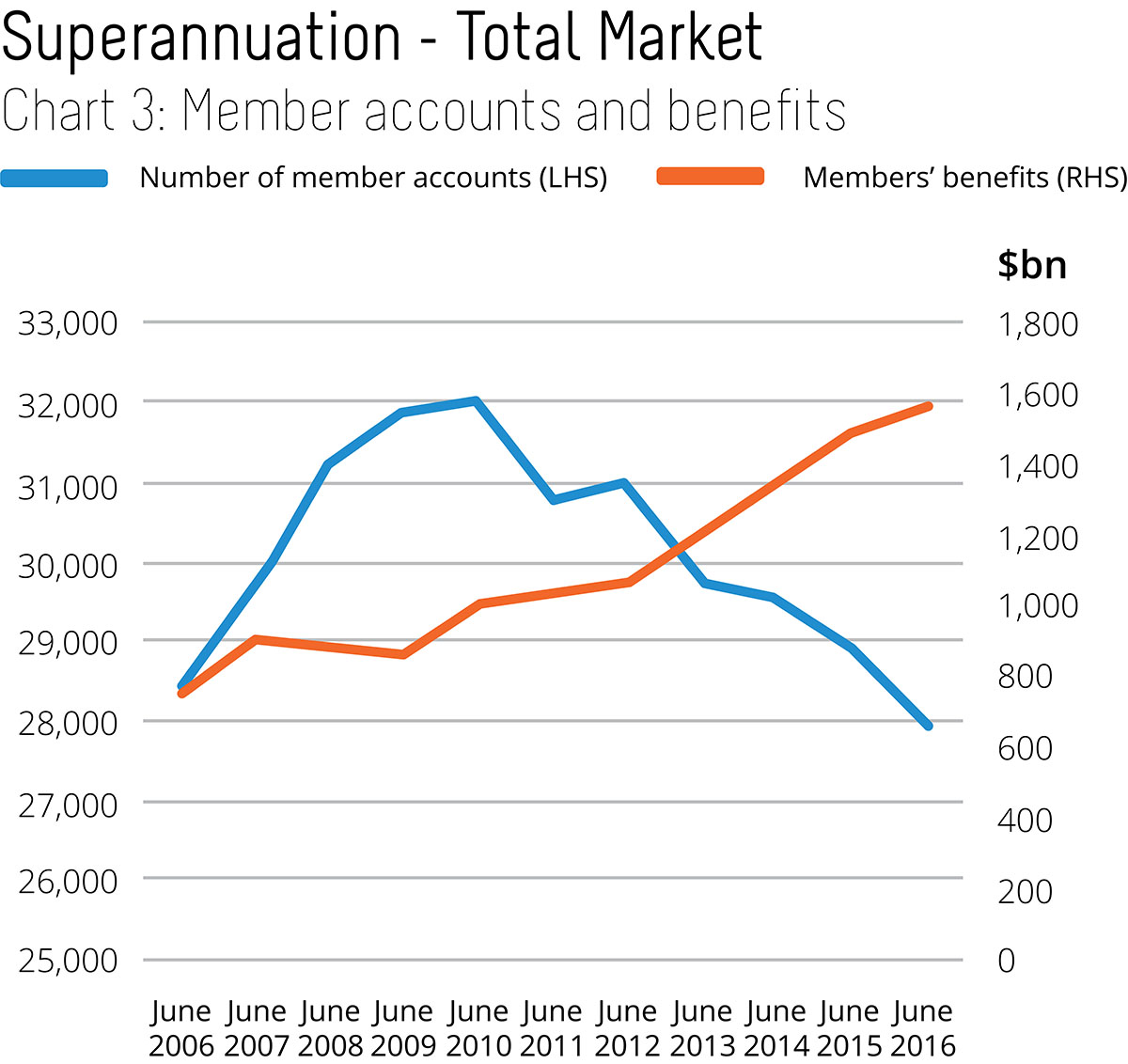

Finally, the scramble for retention is being driven by the reduction in the number of member accounts, from around 32 million in late 2010 to shy of 28 million in June 2016. There is ongoing pressure from the government to reduce the number to somewhere closer to the working population of 12.2 million.

This all means that funds – particularly industry funds which can’t cross subsidise their members by selling banking, insurance, credit and debt products have to compete very hard to maintain their customer base and this might mean a change in thinking.

Here are some of the biggest clues that the CoreData’s research has delivered.

Make choice easy

The majority of members will be (and should be) in a super fund’s default option. From our research, we estimate at least 70-80% of super fund members have very low engagement with their super and either avoid making any active decisions at all (Avoiders), or prefer others to manage it for them (Outsourcers). It makes absolute sense to provide these types of people with a default option solution for their super.

This is supported by the APRA statistics, with 87% of industry fund accounts invested in MySuper products. It’s no surprise then that industry funds have focused their attention on default or MySuper products, rather than Choice products. But those who are more engaged and who do exercise some form of product choice are often higher value members, so while they might make up a much smaller number of accounts, they warrant the fund’s attention.

It might be surprising to learn that these “Choice” members account for almost 36.5% of Assets Under Management (AUM). And over time, as industry super funds become more reliant on an asset based administration and service fees, it will become more important to make sure that almost 40% of your assets under management have a good member experience with the fund.

Choice vs Default Distribution (Industry Funds)

Improve the member experience

Unfortunately, for this group of members, their experience with the fund is often disjointed and clunky.

In many industry funds, as soon as you want to invest in a new super product, such as a direct investment product or retirement product, you need to get a new product disclosure statement (PDS) and fill out an application form. It’s almost as if you have to rejoin the fund. Yes, I know it’s because of all the legal and compliance reasons. But, it’s not a great member experience.

It’s also interesting with all the focus on retirement income products that the pre-retirement experience is likewise underwhelming. At some super funds, if a member joined via a default option and decided they wanted more control over their investments as they approach retirement (via investing directly in shares) as well as a Transition to Retirement (TTR) strategy, they would have to:

- Fill out an application to join the Direct Investment product

- Fill out an application to join the Pension Product

Now this is a worst-case scenario. Most members would only have to fill out the Pension product application form to do a TTR. But with more members moving into retirement, it is likely that a TTR strategy will become more common. Wouldn’t it be a far better member experience if they only had to fill in one form for all choice products – and better yet, if the entire process was digital? In an ideal world, a member should be in as few or as many products as they want to be, without having to fill out multiple application forms.

The platform approach

Platforms are not new and retail funds and advisers have been using them for many years. While these platforms may have been designed to make life easy for financial advisers, they have the added benefit of making life much easier for the member.

The last thing I am suggesting is to increase the fees for industry super fund members by adding another layer of administration. But if a member does become more engaged and wants greater control over their super, the movement between investment options and products should be seamless. If a super fund used a platform, or master trust structure, it would allow the member to join the fund once and have multiple products if required.

The future platform structure

Future proofing super

In the future as many super funds look to maintain growth and provide more comprehensive savings and retirement solutions to their members, this may require them to offer more products. Without a platform or master trust structure in place, members will be required to fill in many different application forms every time they move into a new product.

If super funds choose to move into the wealth management space, it is possible that they will have a range of products both inside and outside of super. In this future, super funds may become distribution providers for a number of products that help members better manage their money and maximise their savings for retirement. If super funds become distributors, they will need to have a platform that allows members to easily access products – similar to shopping online at Amazon.

This future may seem a long way away, but super funds need to start building infrastructure and product strategies that allow them to be flexible and grow, whatever the future product offering will be.

Creating a great experience for all members must be first and foremost in the mind of the fund, while products should always be secondary.