The future of Australia’s aged care landscape includes high-rolling, premium aged care accommodation, obviously with a hefty price tag.

Entering the new aged care market in the next 10 to 20 years will be Australia’s baby boomers, who own around 55% of the nation’s wealth. This generation has the capacity to pay for luxury offerings, being the largest holders of household wealth of any generation.

The shift towards aged care offerings targeting the privileged is already underway; Perth currently has seven aged care facilities charging more than $800,000 for a Refundable Accommodation Deposit (RAD). Demand is high, with majority of these accommodation placements having extensive waiting lists, suggesting that we are only going to see more luxury high priced accommodation in the future.

Innovative and high value offerings are also emerging in dementia accommodation. Glenview Community Services, with backing from industry super fund HESTA, is set to build Australia’s first dementia village in Tasmania based on the world renowned Hogewey model in the Netherlands.

Growth in the aged care market will not simply be driven by changes in Australia’s population, but also by greater value offerings as the sector moves towards deregulation.

So how did we get here?

In 2014, aged care providers were told that they must apply to the Aged Care Pricing Commission to price above the $550,000 threshold for RADs or the equivalent amount for a Daily Accommodation Payment (DAP). The goal of this was to make aged care more affordable, and aged care providers sweated on its potential impact on margins.

The value of the commission has been questioned by many in the industry and its hard to make a case that this process had any real impact on reducing cost for the end consumer. In reality, price controls have acted as unnecessary red tape as opposed to actual ceilings on prices.

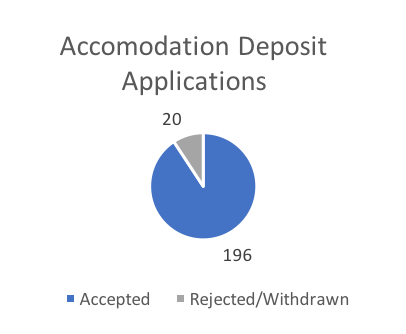

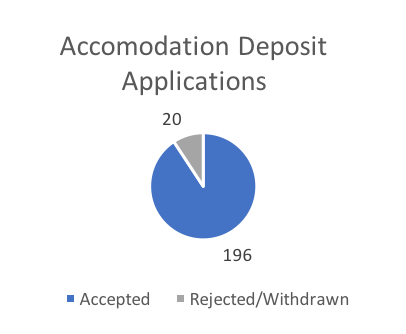

The figures are startling, in 2016 the Aged Care Pricing Commissioner did not formally refuse an application to price above the $550,000 imaginary RAD threshold. While all providers that applied to charge more for extra services that read the fine print were approved (you can’t apply if you have had an approval approved within previous 12 months.

So why have an application process in the first place? One could argue that the red-tape surrounding the aged care sector has allowed the aged market to manage growing pains in its transition to a more consumer-centric system. However, many in the industry believe it is an unnecessary obstacle.

Ultimately, with greater deregulation and cost pressures for government, saving Australia’s wealthiest from luxury and potentially overpriced accommodation is likely not a priority. Money must come from somewhere and the government has clearly indicated the need to reduce its exposure in the industry.

What the commission’s approval figures should remind us is that there is absolutely a place for premium offerings in Australia’s aged care sector. Regulations introduced over the last five years have offered us a clear picture of the Government’s intentions – those being deregulation and creating an open, consumer-centric aged care market.

Aged care providers will be allowed to develop services and accommodation types to suit demand for luxury or premium offerings, however they must look within to compete on price, service and quality.