‘Nothing but the best will do’ is usually what consumers expect of financial services providers, including super funds. Consumers want the best fees, the best returns, the best service, the best insurance, the best advice and so on.

However, when it comes to choosing a new super fund, CoreData’s recent Member Growth research found that being ‘average’ across all the critical aspects may just prove to be enough for a fund’s member retention and growth strategies.

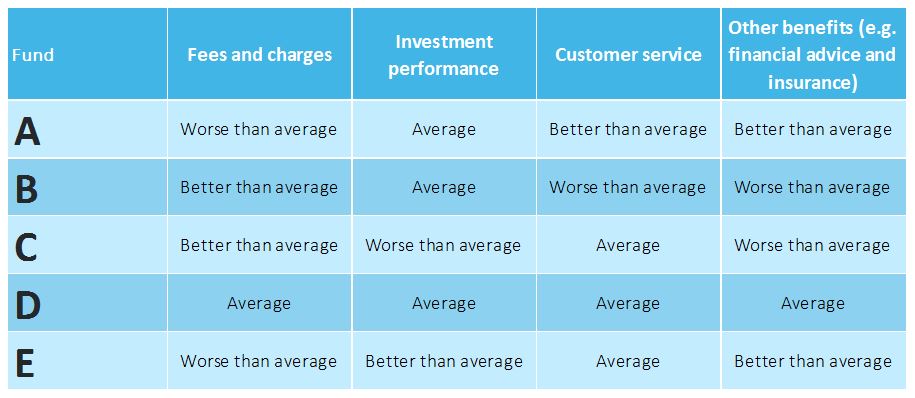

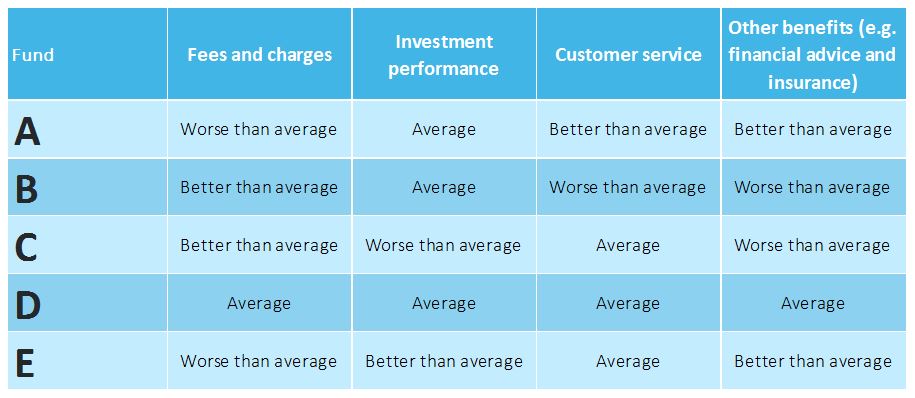

In the research, respondents were given five different sets of four hypothetical super funds and in each set, they were asked to nominate the fund they would most likely and least likely join.

So which of the five funds did respondents most favour? Is it Fund E with its ‘better than average’ investment performance? Or Fund B or Fund C with its ‘better than average’ fees and charges?

In fact, Fund D came out on top, regardless of member age or gender, as well as their attitude to managing finances and super or their level of commitment and loyalty to their fund. What is interesting is that Fund D is not ‘better than average’ in any of the critical aspects, but more importantly, it is also not ‘worse than average’ in any of these aspects.

Why might this be? In their marketing initiatives, super funds typically trumpet how they are ‘better than average’ in one or more of these critical aspects. However, this could lead consumers to question their superiority claim. After all, if many funds claim to be ‘better than average’, then which ones are really ‘better than average’?

Furthermore, past CoreData research found that when asked directly, most members could not elaborate on how much their fund’s fees or returns were. In fact, a typical sentiment was neatly encapsulated in a quote from one focus group participant below.

“I don’t know if the performance of my investments is above average, but I know it isn’t below average”

Human nature dictates that being ‘worse than average’ is undesirable. At the same time, consumers also grapple to grasp what ‘better than average’ actually means to them.

This does not mean that a super fund should not strive to be ‘better than average’ across the critical aspects. Naturally a fund that is ‘better than average’ across the critical aspects will have a competitive advantage against other funds.

However, this is inherently difficult to achieve in reality – a fund with ‘better than average’ fees is unlikely to offer ‘better than average’ returns, service, insurance, advice and so on.

The crux of it all is that ‘average’ becomes the best alternative for consumers, even at the expense of ‘better than average’, as long as they can avoid ‘worse than average’. This may force an interesting rethink in how super funds frame their marketing messages to consumers in their member retention and growth strategies.