The latest round of CoreData Home Loan Mystery Shopping in which 275 customers moved through the home loan process showed a rapid shift in channel behaviour. The Mystery Shopping Process which included a sample of 80 banks shops across the big four and 195 shops across the broking industry showed bank speed to service improvements are out stripping the broking industry.

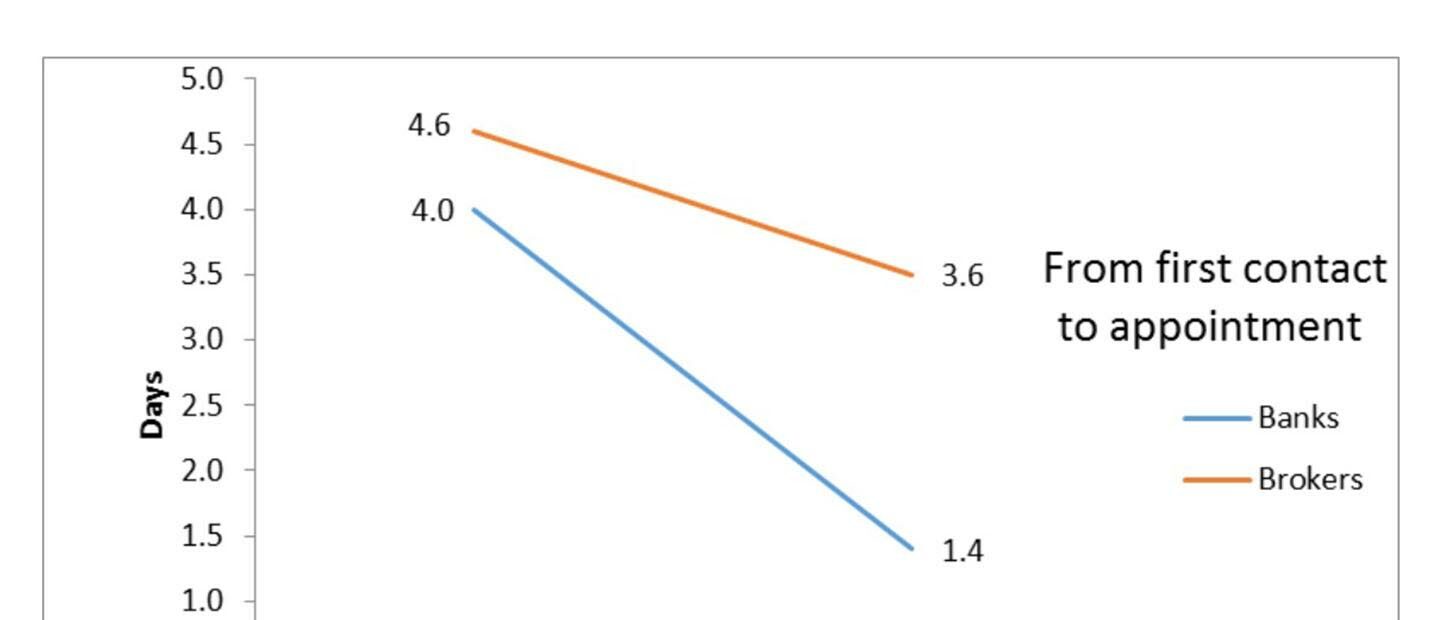

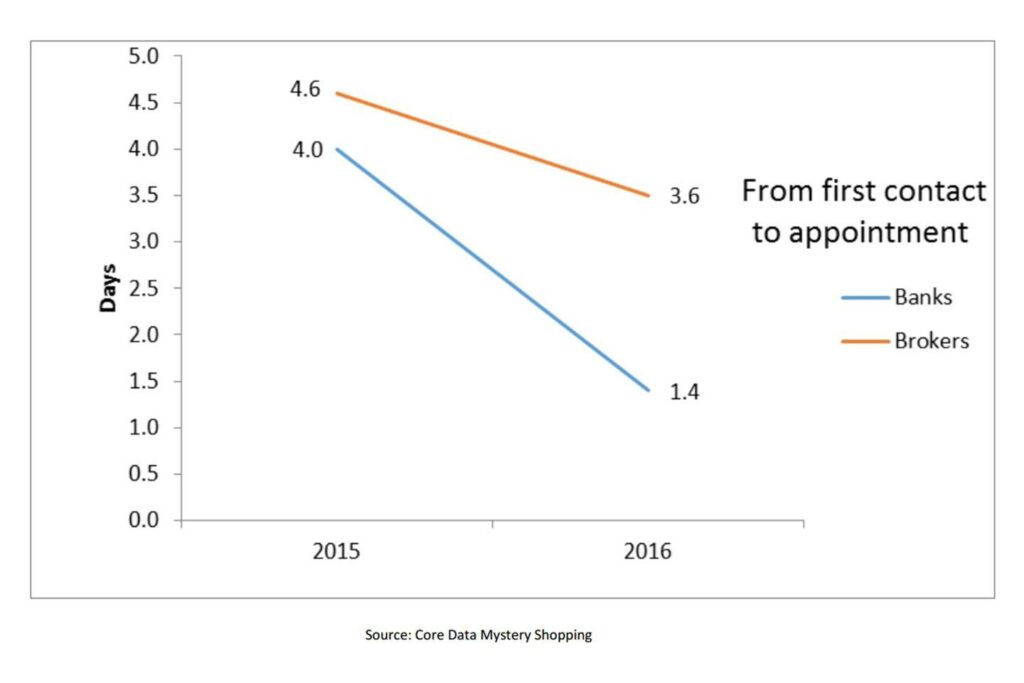

The major banks have made big improvements in their speed to service customers seeking a home loan by reducing the time it takes from first contact to appointment from an average of 4.0 days in 2015 to 1.4 days in 2016.

This improvement has been achieved through investment in people and processes to try to stem the flow of volume to brokers. While brokers have also improved the gap between the two has increased from 0.6 to 2.2 days.

Additionally, holes in the broker process remain. In this sample, in only about a quarter (28%) of CoreData’s Mystery cases do Brokers request customers bring supporting documents to the appointment, causing further delays before the application can be lodged.

Whether or not this will allow digital players, who gather all of the data online, to gain an advantage as it has done in Germany’s booming housing market, where the virtual bank INGDA is growing fast is yet to be seen.