When deciding who to engage with to manage their financial affairs, consumers have a dizzying array of options to choose from.

Advisers possess varying degrees of education and professional credentials, some are associated with big financial institutions, some advisers are specialists in a particular area (such as investments, tax planning or insurance), while others may focus on holistic advice.

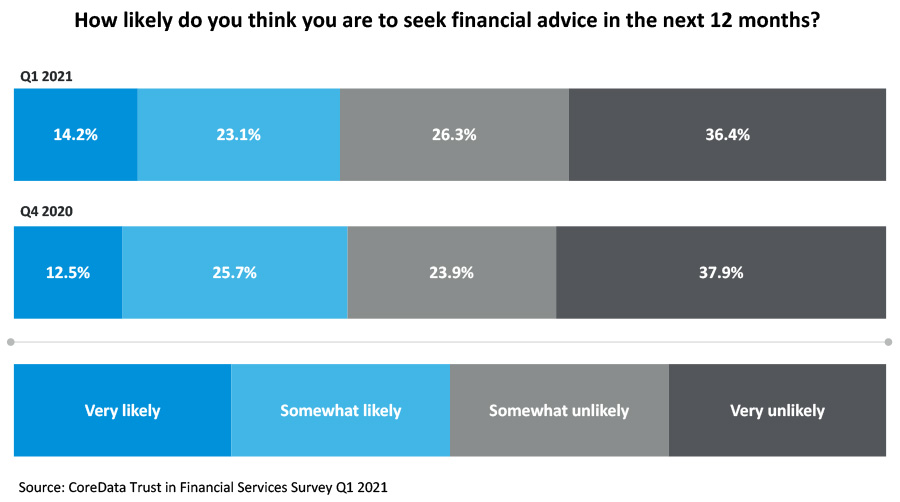

While the demand for advice remains stable – about one in seven consumers say they are very likely to seek financial advice in the next 12 months – whether to go with an adviser at a branded firm or a one- or two-person shop is an important consideration.

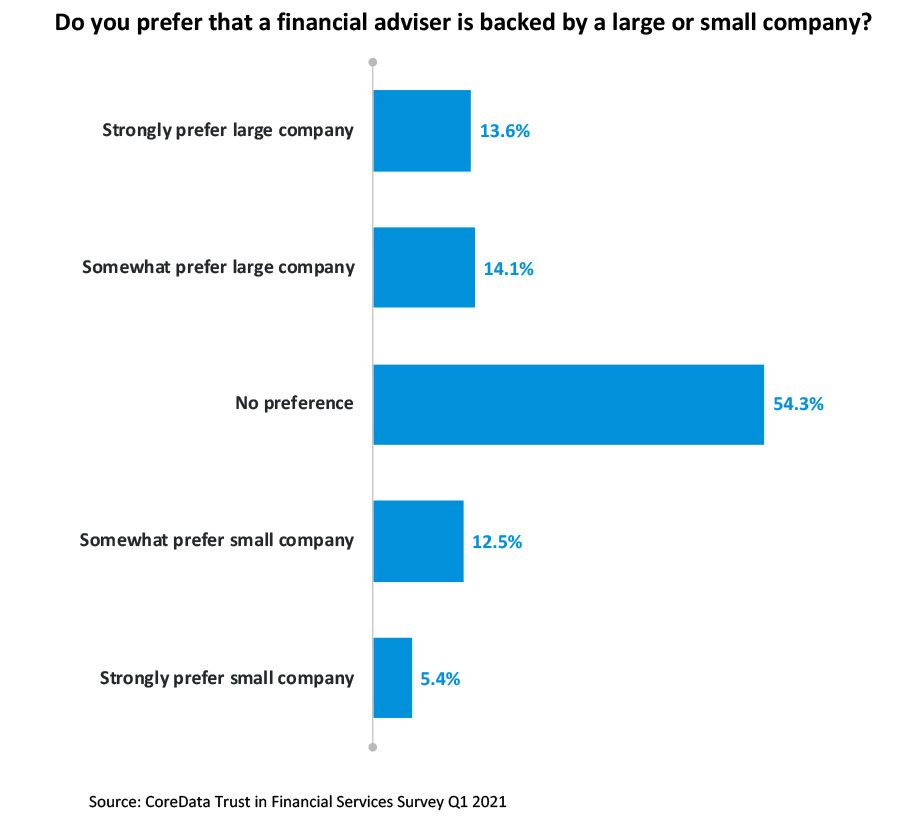

CoreData’s latest research shows that when choosing an adviser, the size of the business that financial adviser is backed by does not play as important a role as the institutional association of the advice business.

Institutional association matters

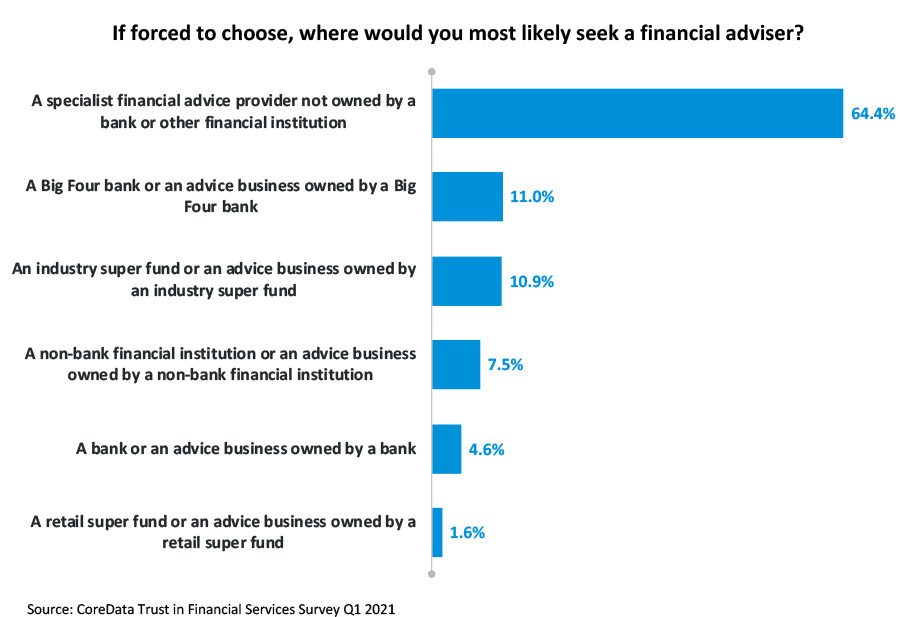

More than half of consumers say that if they were forced to choose a financial adviser they would not have a preference for a large or small firm. But they would clearly prefer a specialist financial advice provider. They are not keen on financial advice firms owned by banks, non-bank financial institutions and superannuation funds.

On the one hand, advisers authorised by institutionally owned licensees potentially benefit from those institutions’ scale and resources, as well as well-established systems and protocol. But as the fallout of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry illustrated, an adviser’s own reputation may suffer as collateral damage to the tarnishing of an institution.

Consumers trust you by heart and head

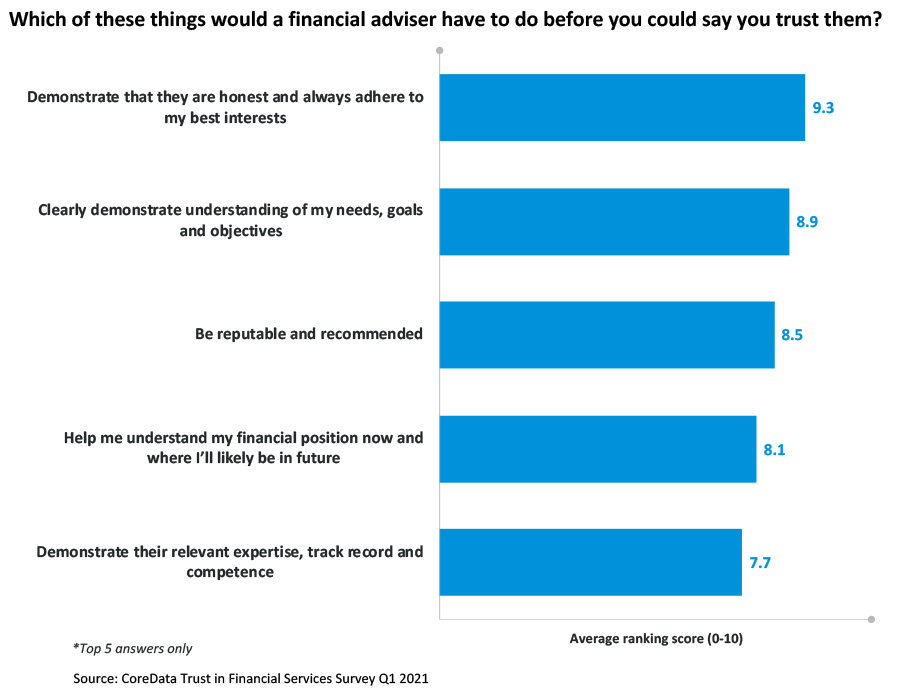

Irrespective of a licensee’s ownership, there are clear things consumers are looking for in any adviser as a basis for establishing the trust necessary to sustain a relationship over a period of time.

Our research shows the relative strength of factors that contribute to consumers’ trust in financial advisers. The number one factor is the perception of whether financial advisers are honest and always adhere to the client’s best interests.

Consumers do not only look at hard measures of competence and quite often they do not have (or have time to investigate) all the information to rationalise an optimal solution. Their decision-making process is often a combination of cognitive and emotional efforts. Judging by heart, consumers also want to feel that the service provider genuinely acts in their interests and they are really who they say they are.

Advisers’ competence is important but is a less important consideration. Research shows that cognitive trust stemming from the competence of the service provider can reinforce affective trust and improve the overall trust level together.

This is also consistent with what we have discovered in previous research: consumers will trust advisers more if they comply with new professional, ethical and education standards.

It can be frustrating for advisers who have been working hard for clients’ wellbeing to see how misconduct of a small percentage of advisers has tainted the industry’s reputation, creating a barrier for them to attract new clients.

But establishing trust, and the factors that consumers rank as important in developing a trusting relationship with an adviser, can be practised by all advisers – regardless of the size of the business, and regardless of the ownership structure of the licensee.