Melissa Caddick was just one more in a line of people who over the years have given financial advisers a bad name, even though she wasn’t even an adviser. The majority of advisers work hard for their clients and are committed to upholding high professional, ethical and education standards. Yet clearly, bad apples continue to taint the reputation of advisers and the industry.

Many Australians remain in the dark about what a financial adviser actually does. Common misconceptions are that financial advice is all about investing, that it is of greatest benefit to people who are older or wealthier, that it’s expensive and that most people don’t have complex enough financial needs to make advice worthwhile.

Countless pieces of research have been done on the value of advice that debunk these misperceptions.

IOOF’s True Value of Advice research shows that advice improves the financial wellbeing of Australians who receive it, which flows on to better overall wellbeing, including improved mental and physical health and healthier relationships. More importantly, the most common barriers to receiving advice – not feeling that circumstances justify the need and feeling that it is unaffordable – are perceived rather than real, and that the value of advice transcends age, wealth and gender.

To further highlight the value of advice, CPA Australia’s Value of Advice research shows that in a best-case scenario where all Australians had access to properly implemented advice, the total contribution to the Australian economy would be approximately $630.3 billion per year.

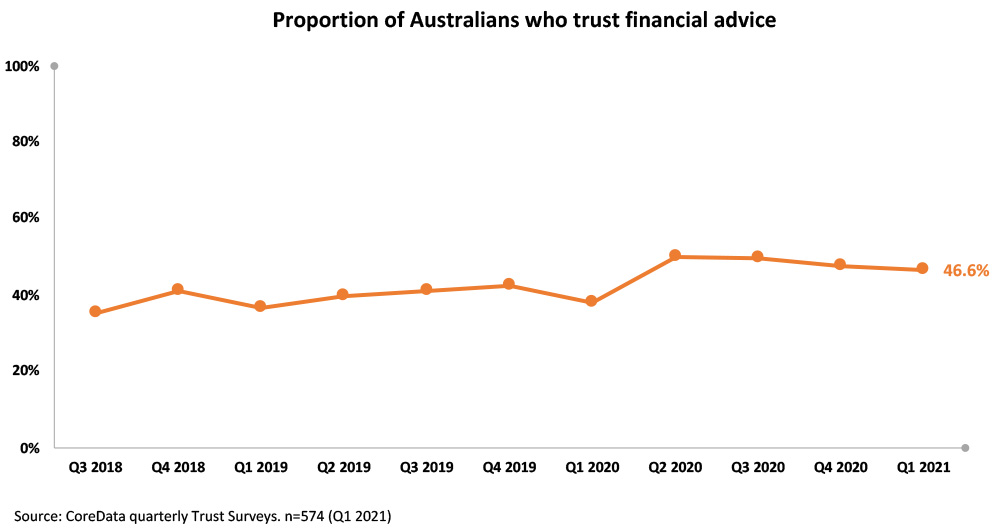

Despite this array of impressive evidence on the value of advice, the dial hasn’t really shifted. CoreData’s research over the past two decades has consistently found that at any point in time, only around one in four Australians are receiving advice. CoreData’s quarterly Trust research has also found that trust among consumers is relatively low, with only two in five (41.4%) trusting financial advisers and less than half (46.6%) trusting the broader sector.

If most Australians form their awareness and perceptions of advice from stories in the media, they could also learn about the unarguably positive aspects of financial advice from the media as well. An obvious place to start would be to start telling the world about the education, professional and ethical standards currently in place and coming into place in the near future. We already know the public reacts positively when they learn about the standards. (It would also make it less likely people would fall for individuals describing themselves as “financial advisers” when they’re not).

Unfortunately the media does not tend to report ‘good news stories’ like they do ‘bad news stories’. Bad news sells and generates clicks and views. The media does not report planes landing safely because that is what planes are supposed to do. But they do report planes crashing, because crashes are the exception to the rule. Similarly, the media reports advice going wrong because it is not meant to go wrong. Think of this as a positive as, fortunately, it is still the exception to the rule.

So it is time for the industry itself to be bold and take the lead in establishing and owning a positive narrative on the value of advice, for the good of the industry and for the good of more Australians. Reports like IOOF’s and CPA Australia’s are an important part of building that narrative.

It is time for the industry to seize the initiative because the media is not going to do it, and nor is the Government. Client success stories and case studies – showing the real-life experiences of people who have benefited from advice – are a tried-and-tested way of exposing and reinforcing positive messages.

The situation cannot change overnight so the aim should be to consistently to chip away at it over time. But until the industry makes a real move on this front, we will be talking about the same things again and again in the years to come. And that would be a shame.