Surveys are a cornerstone of impactful thought leadership and robust market research. They can glean insights into the attitudes and behaviours of market participants that are often inaccessible through secondary research methodologies.

Advanced analysis techniques – such as index construction, regression analysis and cluster analysis – can help researchers gain richer understanding of quantitative data, and, in the case of indices, add value by combining primary and secondary research sources.

This article outlines the application of these methods and provides examples of how they can elevate thought leadership and enhance research outputs.

Indexes: Benchmarking performance to elevate your brand

An index aggregates data into a single metric, allowing firms to track trends and benchmark performance over time. This synthesis of complex information into a simple to understand score can help researchers identify overarching patterns.

Developing an index can be a highly effective way for firms to associate their brand with relevant themes – such as global retirement outcomes or sustainable investment trends – and establish credibility. A well-maintained index, released on a predictable schedule, can help position firms as a go-to resource for market intelligence and insights on a given topic.

The Natixis Global Retirement Index which CoreData has supported since its inception in 2012, demonstrates how an index can become a valuable resource for both clients and the broader industry.

The annual report provides a deeper understanding of retirement security around the world using financial metrics alongside non-financial factors including health, quality of life, and material wellbeing. This index provides Natixis with a platform to disseminate actionable insights and best practice in retirement policy, cementing their standing as a leading voice on global retirement welfare.

Top 10 countries 2024 Natixis GRI

Source: 2024 Natixis Global Retirement Index

Regression analysis: Understanding relationships and outcome drivers

Regression analysis is a method that helps identify cause-and-effect relationships among different factors. This technique can be particularly useful for understanding how certain variables, such as client demographics or market performance, directly influence key outcomes like client retention or asset flows.

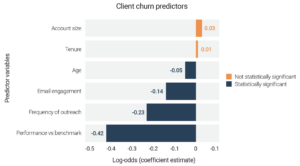

As a practical example, the below regression model analyses simulated client data of a hypothetical fund manager. By examining variables such as account size, client age and how well investments perform versus their benchmark, firms can identify factors predicting the likelihood of client churn. This example analysis reveals that better investment performance reduces the likelihood of clients leaving and that older clients are less likely to switch managers.

Effective regression analysis begins with high quality data. This requires carefully selected, measurable information that truly represents the target group. Research must be planned to avoid common problems such as multicollinearity, where variables measured are too related for dependable results.

By prioritising careful data and sound methods, regression can be leveraged to gain meaningful insights and predictions, while avoiding misleading conclusions from spurious correlations.

The power of regression analysis extends to strategic business questions, as illustrated in these applications:

- Customer targeting: Regression analysis of client data can identify key characteristics of client groups most likely to respond favourably to specific strategies or services.

- Marketing effectiveness: Regression can help assess how marketing efforts impact crucial metrics such as brand awareness, client acquisition costs or client loyalty.

- Pricing and fee sensitivity: Regression can reveal how different pricing models or fee structures affect client satisfaction and retention rates.

Cluster analysis: Uncovering segments

Cluster analysis is a technique that goes beyond demographic profiles, grouping survey respondents based on other commonalities – including behaviours, attitudes and preferences – to reveal distinct segments that might otherwise remain unidentified. This can be particularly useful in helping firms tailor their services and marketing to specific groups.

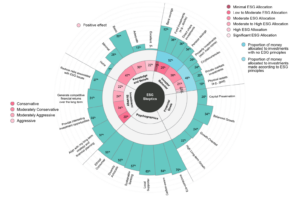

Vontobel’s Mapping the ESG Maze 2024 report, produced in partnership with CoreData, illustrates how cluster analysis was able to identify distinct groups of retail investors based on their attitudes towards ESG investing.

These groups were characterised as ESG Champions, ESG Agnostics and ESG Sceptics, with each exhibiting distinctive attitudes and behavioural drivers. For example, the analysis revealed that ESG Champions exhibit higher risk tolerance and are more growth-oriented in their investment preferences compared to the other two groups.

The insights from the study enabled Vontobel to help financial advisors better tailor their advice, marketing materials and educational content to different client segments.

Example of an ESG investor persona identified through cluster analysis

Source: Vontobel’s Mapping the ESG Maze 2024 whitepaper

Firms can leverage cluster analysis in diverse ways to gain actionable intelligence:

- Customer segmentation: Cluster analysis groups clients or prospects based on shared traits or behaviours, revealing distinct segments within a customer base. This allows firms to understand the diverse needs and preferences of their target market for more customised strategies.

- Competitor analysis: By clustering competitor offerings, firms can map out the competitive landscape and identify distinct market positions. This reveals opportunities to differentiate themselves or areas where competitors are concentrated.

- Uncovering sales opportunities: Cluster analysis can identify patterns in client preferences and behaviours that point to potential cross-sell or upsell opportunities. Understanding these patterns allows firms to offer more relevant products and services to existing clients.

Leveraging advanced analysis for deeper insights

Combining the complementary attributes of primary research and advanced techniques can unlock richer, more nuanced findings when used in the right context and executed properly. The insights gleaned can help craft differentiated, original thought leadership and foster greater understanding of key industry trends and the forces shaping them.

Aymon Blundell and Demy Limbo are research consultants at CoreData Group, a global specialist financial services research and strategy consultancy. To find out more about our industry insights and research programmes, you can reach them at [email protected] and [email protected].