Today’s investment leaders are inundated with thought leadership content from asset management firms – from newsletters and market outlooks to white papers and webinars. And they are discerning in how they allocate their time – most will only truly engage with a handful of standout pieces each month.

To cut through the noise and gain decision makers’ attention, firms need to understand what asset owners value most in thought leadership and ensure these attributes become a north star for their content creation.

We recently interviewed a number of CIOs and investment directors from our asset owner panel to find out what type of content deserves their attention and what added value looks like for them.

Here are some of the key takeaways to consider.

Is your content bold – or original – enough?

A recurring theme among the asset owners we interviewed is that content which leans towards the more contrarian or controversial end of the spectrum is most likely to earn their attention.

“I want to read something contrarian and understand the logic behind it,” says a CIO at a Korean pension fund. “I remember back in 2021 when Jerome Powell was saying inflation was transitory and a lot of managers were supporting his outlook – one white paper that impressed me had a strong counter argument and that actually influenced my decisions in US real estate.”

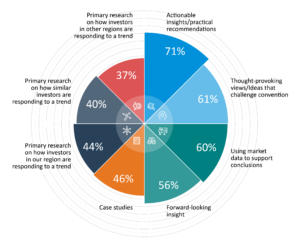

This sentiment was also evident in a global asset owner survey we conducted last year, in which thought-provoking views and ideas that challenge conventional wisdom were cited as the second most important ingredient for thought leadership to add value.

Importance of attributes to the usefulness of thought leadership (% ‘Highly important’)

Source: 2024 survey of 325 investment professionals from CoreData’s proprietary asset owner panel

Being thought-provoking doesn’t always mean disagreeing with the consensus – but it does necessitate having some original insights or viewpoints.

“If an active small cap manager concludes that active pays in that market segment, that is obviously information I already have – but I would be interested if they put across an in-depth argument supporting their case that goes beyond just reciting the conventional wisdom,” says a CIO at a German insurer.

As with the investment process itself, asset managers’ thought leadership content will need to strike a balance between contrarian and consensus views. But where it does lean towards the consensus view, drawing on primary market research to better understand current sentiment, the rationale behind it and what may cause it to shift will make it more valuable for investment decision makers.

“I want to know the main topics the asset managers are focusing on as that supports my understanding of market sentiment,” says a CIO at a German insurer. “But to add value there has to be a discussion that goes beyond what is already priced in – what’s the next factor I haven’t considered that could affect my portfolio? From which direction? And how can I plan for that?”

PGIM’s Global Tail Risks Report is a good example of thought leadership that addresses that question of, ’what might investors be missing?’ head on. The research, supported by CoreData, identifies tail-risk scenarios with perceived low likelihood of occurrence, but potentially high impact – and discusses how investors can prepare for them.

Are you presenting a balanced debate?

Good thought leadership should put across strong viewpoints on a topic – whether it’s building the case for an emerging opportunity, investment philosophy, or risk outlook.

But there is a difference between presenting a balanced argument – ideally supported by evidence and independent data – that reaches a strong conclusion, and navel-gazing content which is overly biased and ignores countering viewpoints altogether.

A sophisticated asset owner audience will simply discard the latter. “As investors, we understand there is always potential upside and downside. I’m taking bets every day, and when my hit ratio is over 50% I’m adding value,” says an investment director at a Dutch insurer. “So when I read their content, I want to see balance in how conclusions are arrived at, with independent data, and some discussion about what can go wrong.”

Climate investment is an interesting topic to consider in this regard.

Robeco’s Global Climate Investing Survey, which has been tracking asset owners’ approach to climate change since 2021, highlighted a notable drop in prioritisation among North American investors in 2024, while conversely, Asia-Pacific investors are putting increasing emphasis on the issue.

This study, which sourced primary data from our proprietary database of asset owners, illustrates some of the divergence that has arisen on climate change within the investment community. Heightened geopolitical risk, uncertainty from policymakers and a deepening understanding of the complexities and costs of transition are among the various factors underpinning this.

Asset owners say compelling thought leadership on the topic should address this complexity to be considered credible. “Decarbonisation of the economy will take time, and there will be lots of different opportunities in products and services that are still needed,” says a CIO at a German insurer. “You have the risk that those assets that are directly focused on decarbonisation are overpriced and more reluctance to talk about the rest. And you have a different pace of transition in each country or region. I think the discussion should reflect that reality.”

Are you tailoring recommendations to different audiences?

Asset owners want content that brings new ideas to the table to help them solve portfolio challenges – our survey found that actionable insights are the most important ingredient for thought leadership to add value (see chart above).

The investment leaders we interviewed also stressed the importance of tailoring those recommended actions to different investor profiles.

So, while a flagship report or piece of ‘hero’ content may discuss an asset class outlook or thematic trend at a broad level, it is important to be more nuanced when it comes to laying out potential next steps for each target audience.

This could mean mapping recommendations to hypothetical investor profiles or portfolio scenarios. Or, depending on the topic, a channel-specific approach may be required.

“We have a different context as an insurer – for example, we think about relative return compared to the risk-free rates,” says an investment director at a Dutch insurer. “We want to see where are the inefficiencies or the opportunities from a relative return perspective. I sometimes find managers with an insurer as their holding company produce more useful content for us because they frame insights with the relevant context.”

Of course, it is not always possible – or desirable – for a single piece of content to address the idiosyncrasies of each asset owner segment. But there are practical ways to increase its relevance for a cross-section of investors – and in our experience, it is worth taking the time to do so.

Our research findings make clear that managers whose thought leadership content is bold, balanced and sensitive to the pressures facing different audience segments will stand the best chance of success in the battle for asset owner attention.

Joe Dalton is a senior consultant and head of thought leadership at CoreData Group, a global specialist financial services research and strategy consultancy. To find out more about our industry insights and research programmes, you can reach him at [email protected]