Australians financially impacted by COVID are now able to access their super early.

And while super funds have expressed their willingness to make these payments, the super industry has been pretty clear that it doesn’t really think early access is in members’ interests.

We’ve all seen the numbers. Depending on time and rates of return, withdrawing $10,000 today could mean around $50,000 to $75,000 less super in the future.

The maths are clear but do they really tell the whole story? Can we really conclude that accessing super early is a bad idea?

CoreData research says not. In fact, the data shows that accessing their super early may be the smartest decision a member can make right now.

Australians worry about money. And those money worries extend beyond our emotional wellbeing. 3 in 10 of us suffer from financial stress. When we’re financially unwell, we’re two and a half times more likely to have problems sleeping. We’re more than twice as likely to have problems with our personal relationships. In fact we’re three times more likely to be involved in an abusive relationship.

Clearly, if we can reduce financial stress today, then we should. Accessing super will undoubtedly relieve some pressure and enhance wellbeing right now.

Happy today, miserable tomorrow?

But what about down the track? Will we necessarily be miserable in retirement just because our super balance has suffered?

Again, the data says no. That’s unlikely. Our Best Possible Retirement research shows that money is not a major driver of retirement satisfaction.

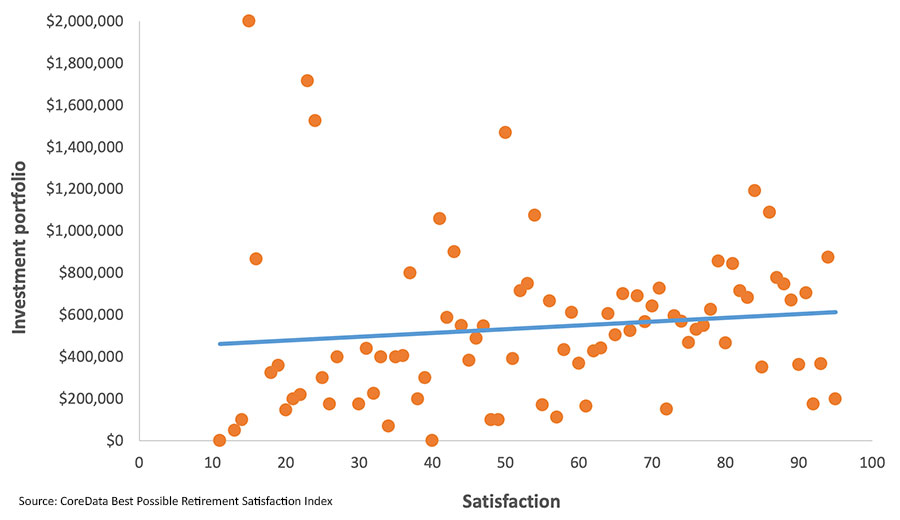

CoreData’s Best Possible Retirement Index provides a standardised measure of retirement satisfaction. It provides insight into what’s really important to Australians.

The Index produces a score from 0 to 100. The mean score is around 50; 100 is a perfect retirement satisfaction score; and 0 is the absolute worst-case scenario.

This chart shows that wealth is not really a driver of retirement satisfaction at all. On the vertical axis we have household wealth, increasing from the bottom up. On the horizontal axis, we have the Best Possible Retirement score for retirees, increasing from left to right. Each dot represents an individual respondent in our quant study.

If wealth was a major driver of retirement satisfaction, then we would see a strong positive correlation. We would see a linear increase from bottom left to top right. Poor households would have low index scores and rich households would have high index scores. But we don’t see that at all. In fact, some of the most satisfied retirees are also the poorest.

So the data is clear. The lifestyle benefits of accessing super today are more likely to be greater than the lifestyle costs in the future.

If you’d like to learn more about what the real drivers of member retirement outcomes are and what super funds should be doing right now for the benefit of members, please give us a call.