Life used to be simple for asset managers, well simpler at least!

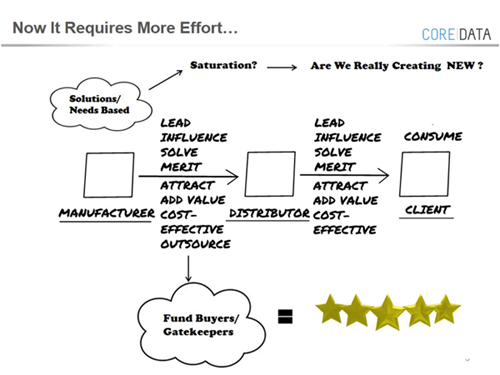

In the not-too-distant past, when there was still plenty of mispricing and alpha to be found in large cap stocks, manufacturers used to create products at will and push these into the market by paying distributors (financial advisors) to sell these products to willing (unsuspecting) clients.

How times have changed.

In what feels like a relatively short period of time, the industry has gone from product selling… to curating solutions!

Pre-financial crisis, the hurdles to overcome for getting into fund selector arenas and onto approved product lists, platforms and the like were easier and quicker than today.

A swanky lunch, some fine wine and a nod from a mate, and hey-ho your fund is listed and open for business at a big wire-house, on a platform or in an advised group network’s approved product list.

Next step was to unleash your wholesalers on the advisor community to get face-to-face and promote why your fund/s is/are better, special and different.

Not anymore – the shelves are already stacked. Why do the Merrills or the Morgan Stanleys of the world need to add another US Large Cap manager into their line up?

The honest answer is that they don’t. But if you’re outside the tent what do you do? Innovate?

The industry is calling it outcome-based or solutions-driven investing. We call it competition!

And it appears to have led to an explosion of innovation, or at least product proliferation.

Today there is a strategy to do pretty much anything you want to do from an asset holding, risk positioning, time horizon, and investment structuring etc. perspective – all from the reverse point of view of an outcome.

With a greater focus on these outcomes, rather than selling what managers release into the market (or at least what their sales and marketing teams sensed was needed/could be sold), the industry has trundled towards this new look over the past five years since the financial crisis.

However, at the end of the day the same assets are being used to create these new ‘solutions’ as was the case pre-crisis, so what makes things different this time around? Perhaps this is a new paradigm? They always are, mutter the cynics among us…

Nonetheless a few drivers have combined to varying degrees to bring us to where we are today.

- Regulation (the ongoing drive towards greater transparency and removal of opaque industry behaviours)

- Technology (the information era, the rise of passives, algorithm based and high frequency trading)

- Greater due diligence of produce selection (gatekeepers now more influential, time to market is slower)

Combined, manufacturers now need to do a variety of things to succeed. Enter the role of the content marketers through so-called Thought Leadership.

Content marketing is king as groups jostle to be seen and heard more so than they had to in the past.

Perhaps, but from the point of view of most asset managers, at least these focus on distributing via the traditional intermediary channel, the only kings out there are the fund selectors and gatekeepers.

займы на карту срочно займ который дает всемзайм в яндекс деньгахмфо вэб займ